Brent linked me to Naked Capitalism where the blogger said of the Morgan Stanley Report : This is an even bigger deal than you might think. The Chinese government isn’t shy about putting banks that trash-talk its economy into the penalty box as far as official business is concerned. So Morgan Stanley has to be even more confident of its view than one might ordinarily expect to be willing to incur the ire of the Chinese officialdom.

From the Morgan Stanley Report:

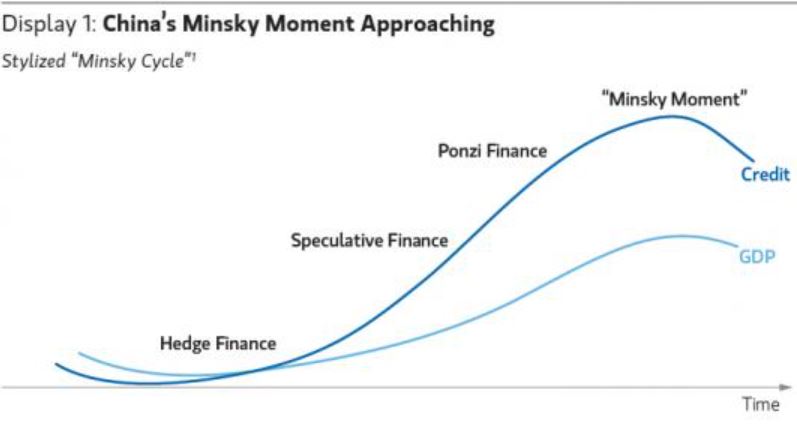

We have described in detail over the past two years how we believe China’s twin excesses (excessive investment funded by excessive debt) will inevitably unwind, causing a substantial slowdown in China’s economy, significantly below market expectations. In recent weeks, a trip to the region and further research into China’s shadow banking system have convinced us that China is approaching its “Minsky Moment,” (Display 1) which increases the chances of a disorderly unwind of China’s excesses. The efficiency with which credit generates economic activity is already deteriorating, as more investments are made in non-productive projects and more debt is being used to repay old debts.

Based on our analysis, our baseline case is that China may slow from the current level of 7.7% Gross Domestic Product (GDP) growth to 5.0% over the next two years. A disorderly unwind could take Chinese growth down to 4% in a shorter time frame with potentially disastrous consequences for levered Chinese assets (banks, property) and the entire commodity supply chain (commodity stocks, equipment stocks, commodity-sensitive countries and their currencies).

RSS Feed

RSS Feed