|

80% of humans have an optimism bias. TED talk. The realists actually go through life being mildly depressed.

0 Comments

Caixin estimates China has 50 ghost cities.

Business Insider.

"Swedish sex toy company LELO is marketing a new product "exclusively for bankers." That's right, it's for bankers only. Here's why, from the company: "Many bankers want more from their profession and their investments; they also want more from their intimate investments. The new PINO™ will be the first sex toy in history that can satisfy the hedonistic sexual cravings and excesses exhibited by members of the financial world." " Well, as regular readers of this blog will note: I would definitely like to bend the banking community over. Does it come with leverage ratios, elimination of OTC derivatives trading, vested bonus pools subject to government confiscation, non compete clauses for regulatory workers (along with higher pay),criminal prosecution, and life time bans for executives caught flaunting the law? Book deal to follow with the working title "50 Shades of Money" GS turns bearish. Via CBC.

"The main reason the bank cited for its call is simple supply and demand — there's just more oil being produced now than the world needs, the bank says. "A boom in shale oil and gas in North America this year and last has drastically increased the amount of oil in circulation. This month, it's expected that the U.S. will pump out more crude oil than Saudi Arabia does — the first time that's been the case since the early 1970s." .... "Saudi Arabia could traditionally control the price of oil by limiting supply due to its status as the world's largest pumper of crude. Now, there's a conspiracy theory going around in oil circles that the Saudis are quite happy to let the oil price go into freefall long enough to convince new U.S. rivals it's not worth it to develop their resources. "Goldman is saying a new oil order has arrived where the Saudis have decided to let the short-term oil price be low long enough to curb U.S. production in the shales," is how Judith Dwarkin, Director of Energy Research for ITG Investment Research in Calgary put it. As one of the cheapest sources of oil in the world, the Saudis can certainly better afford to wait out the current price lull more than most. Projects in Northern Alberta can't afford to have nearly as much patience. "Oilsands are far more sensitive to drops in price," Dwarkin said. "You don't have to go to $75 to be in pain as an oilsands miner."" This is what I said nearly three years ago to the day in the Geopolitics of Energy (Nov .2011) "Systemic imbalances in the global economy are forming, creating the potential for a category five hurricane of volatility and risk. Policy makers once again, despite ample warnings, have failed to buttress the levees. As a result, the storm’s aftermath is likely to be felt for an extended period of time, maybe even a decade. The purpose of this article is to explain why we are entering into a lengthy period of increased economic risk for the oil market and the broader economy. The swing in WTI futures from contango to backwardation, where contracts are trading below spot, is seen, by some, as evidence that producers are hedging their production with the expectation that the global economy will be weak over the next couple of years Most of the mistakes that will be made in capital allocation over the next twelve months will not be because the decision makers misread the economic environment for 2012; many analysts will misjudge the underlying causes of the 2012 recession and fail to see the broader implications of the systemic imbalances. This article addresses how imbalances in the US, Euro area, and Chinese economies are creating significant demand uncertainty in the global economy for the foreseeable future. ...... The US, Europe, and China have internal and external imbalances in their economies that are linked to trade policies; these issues will need to be addressed over the course of this decade. The supply of world oil is coming increasingly from unconventional sources like off-shore Brazil or oil sands in Canada. These incremental unconventional barrels come with different cost structures and lead times, as the price of developing incremental unconventional barrels is not constant. Therefore, the demand for oil will suggest what cost structures and lead times might be funded and accepted and so determines that price (within the envelope of known/reasonably expected technologies and stochastic resource discovery). The issue of oil demand is linked very closely to global GDP growth. We are entering a period of time where global imbalances can no longer go unattended. However, there remains significant uncertainty concerning how these imbalances will be resolved - in an orderly fashion or in response to a crisis? It is certain that global growth prospects will be lower for much of the next decade. Unconventional oil projects have a life that extends well past a decade. In the past, oil markets experienced boom/bust cycles because of oversupply in the market, and this was an issue foremost in the analyst’s mind. Today the uncertainty in global GDP (and its distribution) over the relevant period (10 to 25 years) is the most significant uncertainty. Even if one could bound global GDP +/- 10% 25 years out, that 10% corresponds to a much bigger number than it would have 25 years ago." "The London firm started 2014 with more than US$1 billion under management. But investors have fled, cutting that to just US$440 million, the Financial Times reports."

If there are horseman to the financial apocalypse this would be one of them. I once compared China's "managed" GDP growth to having the same validity as Dilbert's random number generator. China's growth is slowing down but the mandarins keep reporting fake numbers. My Thanks to Brent for the link.

Robert Shiller 2013 Nobel Prize winner. Readers of my blog will find the ideas of the last three Nobel Prize winners well represented on these pages for the last 3 years.

From 2012 Nobel Prize Winner Al Roth (Market Design).

We used to see universities in the US as one of the great engines of social mobility. Think in ourselves as an immigrant nation. My grandparents came from Russia and were tailors. My parents went to college and were high school teachers. I got a phd and I’m now profesor. That was the kind of story we like to tell. Now we worry than that’s less and less true. Rather than be an engines of social mobility, colleges maybe becoming the way that well often educated transmit their inheritance to their children. It’s more complicated than money. Once admitted to Harvard or Stanford, finances are not the problem. The problem is that too few families whose income is 50.000 dollars a year are able to provide the education before college to their kids that’s needed to be admitted to Harvard or Stanford. We have a problem that we haven’t figure out yet, which is how to get talented children from all parts of society to come to universities and get the right kind of education. I think it’s harder for children whose parents have not been to college to want to go to college and to get themselves read to do it. If you live in a community where everyone goes to college, then you know a high school, what colleges, what kind of courses youshould take... It’s a whole path. Praising Jean Tirole’s attempts to “tame powerful firms”, the committee awarding the 8m kronor (£750,000) prize said the University of Toulouse professor was “one of the most influential economists of our time”. The committee chose an area of economics that has become increasingly important as governments have privatised former public monopolies such as water, electricity and telecoms and Tirole’s work has been adopted by competition regulators around the world.

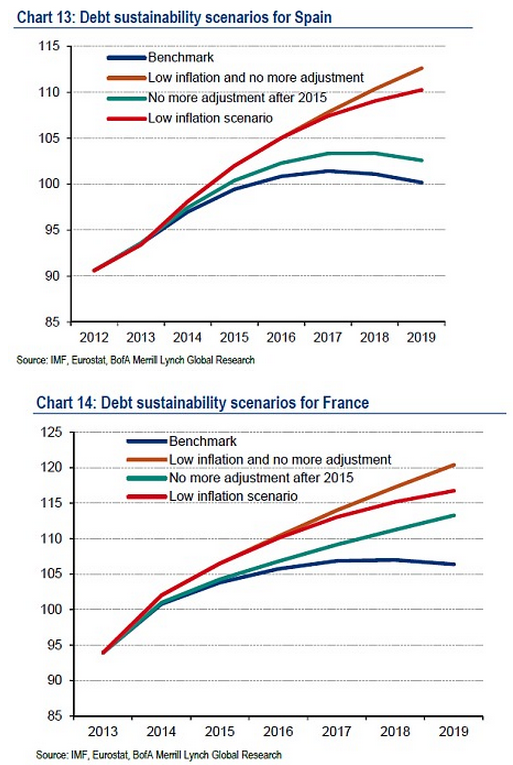

Tirole, 61, has covered a wide range of areas including pay, the banking industry and credit card fees. In a paper last year he scrutinised, with Roland Bénabou, a “bonus culture that takes over the workplace, generating distorted decisions and significant efficiency losses, particularly in the long run”. Ambrose Pritchard from The Telegraph. "Germany’s exports are falling at the fastest rate since the global crisis in 2009, raising fears of a triple-dip recession and a disastrous relapse for the rest of the eurozone. Christine Lagarde, the head of the International Monetary Fund, warned that the eurozone is at “serious risk” of falling back into recession if nothing is done, and is in danger of suffering a lost decade. “If the right policies are decided, if both surplus and deficit countries do what they have to do, it is avoidable,” she said. The wording is a clear call to Germany for an immediate shift in policy. The ECB warned in its monthly report that the eurozone jobs market has failed to recover as expected, with the numbers out of work for 12 months or longer still rising. “It warrants particular attention from policymakers as it points to an elevated risk of a marked increase in structural unemployment across the euro area, and potential hysteresis effects,” it said. In technical terms, it said there had been an "outward shift in the Beveridge Curve". The bank said structural unemployment has jumped to 10.3pc and is worst in some of the crisis countries forced to shake up their labour markets. While couched in cautious language this is an admission that the supposed cure of “labour flexibility” imposed by the EU on southern Europe is not working as hoped, and may stem from a false diagnosis of Europe’s jobs crisis. It called for retraining and other “active labour market policies” to bring millions of marginalised people back into the workforce. This is exactly what critics have been saying all along." Deflationary spiral risk increases "Ruben Segura-Cayuela, from Bank of America, said low inflation has become “the biggest threat to the dynamics of public debt” in the eurozone, warning that debt ratios risk “spiraling up” even at levels of around 0.5pc." I love how the "Benchmark" scenarios all have gdp debt levels leveling off and declining in about 5 years. What a joke. More:

"Analysts are watching German politics just as closely as ECB language. The rise of Germany’s AfD anti-euro party raises the political bar even further for full-fledged QE, and eurosceptics have announced their intention to file cases at the German constitutional court to block asset purchases once they begin. The court has already ruled that the ECB’s backstop measures for Italian and Spanish debt (OMT) “manifestly violate” the EU Treaties and are probably “Ultra Vires”, which prohibits the Bundesbank from taking part. Pending cases on QE would raise questions over whether the Bundesbank might have to step aside on asset purchases. The current circumstances are very different from July 2012, when Mr Draghi had the full political backing of the German finance ministry for his OMT rescue plans. This time he must battle critics across the whole political spectrum in Germany. Giulio Mazzolini and Ashoka Mody, from the Bruegel think tank in Brussels, said the eurozone seems to be tipping into a “debt-deflation cycle” as rising debt and deflation feed off each other, yet the authorities remain paralyzed and still refuse to face up the gravity of the threat. “Even now, ECB officials regard deflation to be unlikely,” they said." |

Categories

All

Archives

November 2017

|

RSS Feed

RSS Feed