|

I think this is an older video dating back to 2011 pre-US downgrade. PIMCO'S El-Erian via Zerohedge. Structural unemployment, central bank creating systemic risk, the Eurozone market design issues and execution.Financial repression, deflation. you have heard it all here before. He is more optimisitc then i am aboout China's ability to manage its economy.

0 Comments

It about inequality of opportunity.

"The absence of rewarding employment opportunities in the lower- and middle-income ranges breaks an important part of the social contract in America, which holds that you are largely on your own but that if you work hard the opportunities will be there. The second part of that contract is now in question. " I shared some of Zerohedge's views and similarly underestimated the ability of CBs/policy makers to kick the can down the road.

i would say that if the US isn't in a official recession by Mar. 2013 I will admit to being wrong. EU held up better (politically) than I thought it would -though economic performance was on par with my expectations. The bottom line is I have been expecting a syncrhonized crisis EU-US-China-Japan and so far the world has managed to muddle through. I still expect this to happen "soon". As an x-boss used to say about forecasting, give a date or a price - but never both. I still believe we are headed for soverign debt crisis which will rival or exceed the Great Recession. But........ May all my pessimistic forecasts be found to be tail events which never happen. Its been a good year for me personally. I thank the readers of this blog for their time and attention. Hopefully you have found something of value from my filters. Happy New Year. Charlie Rose. This is the type of economy China can hope to "improve" towards.

Here is a link to The Economist's (Newspaper) Democracy index. Notice that China sits in the lowest category, as one of the worst countries in the world, 141 out of 167. Russia is in the same category as China, only higher at 117. Brazil is 45, South Korea is 22, United States is 19, Japan 21, Malaysia is 71. So who is China more likely to evolve towards in the next century? Here is a Time article discussing that Malaysia has fallen into a middle income trap. How then is it that China, one of the most oppressive corrupt centrally planned economies in the world, is going to do as well, or better than Malaysia? Malaysian GDP is $8,600- Chinese is $5,200 in 2011 according to IMF. It seems to me the most reasonable assumption is that China will follow a path of crony capitalism as Russia did when the Soviet Union collapsed. Meanwhile, the American dream is still alive in Brazil. From his Annual Report.

"Economies can retreat from excessive debt burdens in three ways. One is “austerity,” where spending is restricted in the attempt to reduce deficits and keep debt burdens from growing as fast as the economy grows. The difficulty with austerity is that it is often self-defeating because economic growth slows and tax revenues often decline enough to offset the reduced spending. A second approach is “monetization,” where the central bank creates currency and bank reserves in order to purchase and effectively retire government debt. This approach may be expedient in the short-term, but can lead to severe inflationary effects in the longer-term. A final approach is “debt restructuring,” where bad debts are written down or swapped for a direct ownership claim on some other asset (known as “debt-equity swaps”). This approach can detach the economy from the burden of prior debts, but it is most contentious politically because it requires lenders to take losses or accept changes in the structure of their claims. In the next several years, it seems inescapable that the U.S and Europe will require a combination of all three approaches. In my view, the likelihood of addressing global debt problems without significant economic and political turbulence is quite low. The primary question is whether losses and debt restructuring will be imposed on lenders who voluntarily accepted the risks, or whether the losses will instead be inflicted on the public through austerity and inflation. My impression is that the answer will be a combination of all of these, and that the ability to navigate a broad range of potential outcomes will be required. Meanwhile, I remain skeptical that central bank interventions targeted at making investors feel “wealthier” will have much real economic effect, or will durably reduce the need for difficult economic adjustments." I think this is the "uncertainty" that is holding back business investment more than anything. The central banks are railing against deflation and the market doesn't know whether they will suceed or fail. ( I vote fail.) Pettis on why it is an important part of the negative self reinforcing cycle. He takes 'The Economist' to task on their China investment/debt analysis.

"The most worrying, but expected, fact was the amount of capital fleeing the afflicted countries. I cited an article in Spiegel that claims that in the past year an amount equal to nearly 30% of Spain’s GDP had left the country. Flight capital is both a major result of declining credibility and a major cause of further declining credibility, and because it is so intensively reinforcing it is a major warning signal. This matters for China for at least two reasons. First, a worsening Europe will make it harder than ever for China to rebalance growth away from investment, and second, China itself is experiencing capital flight." That's what I said. The NY Times on how trade protectionism is accelerating.

"Global Trade Alert, a respected independent survey, titled a June update on trade protections “Debacle.” It bumped up its estimate of the number of protectionist measures enacted in 2010 and 2011, by 36 percent, and warned that countries had many more coming. The European Union also issued a report finding a “staggering increase in protectionism” in recent months." From the WTO report summary: "Implementation of new trade restrictions continues unabated … Since mid-October 2011, 124 new trade restrictive measures have been recorded, affecting around 1.1% of G-20 merchandise imports, or 0.9% of world imports. The main measures are trade remedy actions, tariff increases, import licences and customs controls. There were fewer new export restrictions introduced over the past seven months than in previous periods. The more recent wave of trade restrictions seems no longer to be aimed at combatting the temporary effects of the global crisis, but rather at trying to stimulate recovery through national industrial planning, which is an altogether longer-term affair. In addition to trade restrictions, many of these plans envisage the granting of tax concessions and the use of government subsidies, as well as domestic preferences in government procurement and local content requirements. Accumulation of trade restrictions has become a major concern … The new measures restricting or potentially restricting trade that were implemented over the past seven months are adding to the trade restrictions put in place since the outbreak of the global crisis. The accumulation of trade restrictions is now a matter of concern. The trade coverage of the restrictive measures put in place since October 2008, excluding those that were terminated, is estimated to be almost 3% of world merchandise trade, and almost 4% of G-20 trade. The accumulation of trade restrictions is aggravated by the relatively slow pace of removal of existing measures. Out of a total of 802 measures that can be considered as restricting or potentially restricting trade implemented since October 2008, 18% have been eliminated. At the time of the last monitoring report in October 2011, around 19% of the restrictive measures had been removed, which means that the rate of removing restrictive measures is actually slowing down. Moreover, the accumulation of restrictions has to be considered in a broader perspective where the stock of trade restrictions and distortions that existed before the global crisis struck, such as in agriculture, is still in place. " I identified the issue close to the inception of my blog. Very similar to what I wrote in my Geopolitics of Energy article last November.

David Rosenberg qutoes Felix Zulauf from Barron's Roundtable (via Zero Hedge).

And I feel fine.

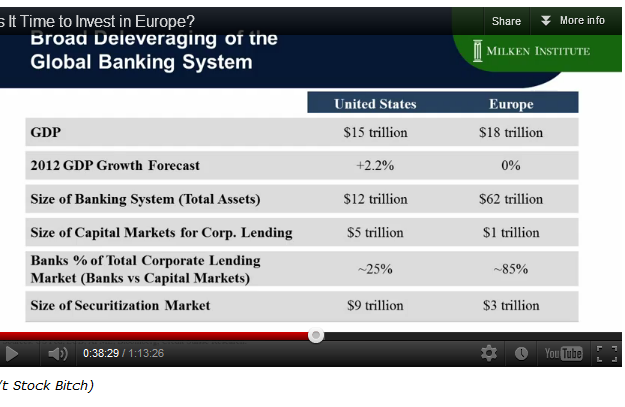

There will undoubtedly be some intervention by the Fed and ECB in the coming weeks that will calm the markets. I have spent a lot of time thinking about the dynamics of how the macro world would unfold since the “Great Recession”. I was more pessimistic than turned out to be warranted with respect to the short term performance of the equity markets. My pessimism was based on a belief that long run growth would be much lower in the next decade, and that the systematic imbalances in the global economy (US-Europe-China) would be very painful. I called for copper to fall in February of 2010, and I called for the purchase of CDS of Spain and Italy in May 2010. I was wrong about the former right about the latter. I also became aware of the OECD issue of structural unemployment. I chronicled these views in an article published in the Geopolitics of Energy titled “Gimme Shelter: Expect More Volatility in the Oil Market over the Next Decade”. In my summary of that article I wrote “We are entering a period of time where global imbalances can no longer go unattended. However, there remains significant uncertainty concerning how these imbalances will be resolved - in an orderly fashion or in response to a crisis? It is certain that global growth prospects will be lower for much of the next decade. For those who are “certain” that the BRICs have decoupled from the developed world, that structural unemployment does not matter and the Europe and US will muddle through and will be back to 3%+ grow soon, I end with the words of the poet Yeats. Excerpt from ‘The Second Coming’: Turning and turning in the widening gyre The falcon cannot hear the falconer; Things fall apart; the centre cannot hold; Mere anarchy is loosed upon the world, The blood-dimmed tide is loosed, and everywhere The ceremony of innocence is drowned; The best lack all convictions, while the worst Are full of passionate intensity." My pessimism was bounded because while I thought from its beginning (2002) that Euro was untenable; I assumed that while things would be markedly worse in China and Japan -their situations still would be manageable. In the intervening 6 months, I have spent a lot of time thinking about transition dynamics and end game, with the recent realization that the former is way more important than the latter. The unprecedented central bank balance sheet expansion by the Fed and ECB that has (temporarily IMO) buoyed the financial markets. Notwithstanding Europe is in recession and it looks increasingly like China, Japan and the US are slowing down. In short - my macro call (that went against the herd) has been bang on. And yet I expected a better policy response from all countries then those that have been evidenced. I expect in the days to come that we will get a good news announcement from the IMF, ECB, Fed or Germany on the Eurozone or US economy that will comfort the markets and reverse the markets current free fall. I am even more convinced that what will be offered will just kick the can down the road and that the road is approaching the end of the cliff. I have become convinced by my studies that policy makers have lost the ability to manage the system and some sort of catastrophic wash out even in the global economy and stock market is coming. There isn’t a single country that is correctly managing its policy response correctly, (imo, though the US is the least bad of a terrible cohort). As an example, below is a screen shot of a slide shown at a recent Milken Institute panel at which Hugh Hendry was one of the participants. There is 62 Trillion in loans the European banking system – many of these will have to be sold for Basil 3.(BTW as a frame of reference world GDP was 63 Trillion USD in 2010.) How much deleveraging is required is difficult to say for sure because I am not sure how much the shadow banking system differs between them. If you assume shadow banking is the same for both than the European Banking system will have to decrease by more than 50%. How much will Basil 3 require? How much can they fudge? How much will be purchased by the ESM/ECB? Regardless, this is inherently deflationary. And then you have the inevitable China and Japan writedowns. Even massive central bank money printing by these countries will make the USD stronger and be inherently deflationary for countries the US (and Canada). It seems not unreasonable that there needs to be a credit writedown across the world that begins to approach 1/2 to 1 year of world GDP. This seems like the mother of all credit market events. My macro view is that Europe and China are going to be trying to devalue against the USD and that this will be inherently deflationary. So I am expecting a massive wave of deflation prompted by a hard landing (collapse) Europe China and Japan. The policy response to this will be massive money printing and inflation. It appears that deflation follwed by inflation will be the transition dynamics. |

Categories

All

Archives

November 2017

|

RSS Feed

RSS Feed