|

While oil prices go up because Iran is making its ususal empty threats, the world is peacefully oblivious to the real threat that is emerging - bio weapons. If Iran really wants to harm the US it could send over a form of weaponized SARS anonymously. Seasons greetings from the ghost of Christmas past, Michael Chrichton.

0 Comments

Does the Iranian regime get to have its own cake and eat it too? They sabre rattle against the US and oil prices go up. They please the hardliners and their primary commodity goes up. Not only that, but the higher prices comes from the US ,the regime’s dreaded enemy. Is this a win-win?

I have been so unrelentingly pessimistic about the world economy for the last 4 years contrary to mainstream thinking. While the markets went through a nervous period in the summer, the optimists seem to once again been carrying the day.

I have questioned my own judgment and whether I am projecting my personal issues onto my analysis. But I don’t believe I am. A recent interview with Robert Rubin and Gillian Tett on Charlie Rose confirms my worst fears. Rubin, the former head of Goldman Sachs and Treasury Secretary under Clinton, characterized the probability that Europe will be able to navigate through the crisis as low and the consequences to the global financial system as catastrophic having second, third, and fourth order affects to the global economy. I can't fully square his analysis, as he did say that European leaders would decide to integrate and form a fiscal union when staring into the abyss , and find a way to muddle through that will take years. But when pressed by Charlie, Rubin emphasized that he had no conviction of this outcome only that the consequences of failure were so high that Europe would have to come together. In this respect Rubin remains more optimistic than I do. This is not just a matter of shifting the burden of financial system indulgence to the tax payer as happened in the US in 2008. I see nothing from a game theory perspective to suggest there is mutually assured destruction in proportionatel measure across every nation. I don’t believe even France and Germany’s interests would be the same when faced with a catastrophic collapse of the financial system much less Greece, Spain, Italy Portugal, Ireland or Finland and Austria. Adjustment requirements and burdens vary dramatically across the Euro zone. The burden of this adjustment process must fall on Germany if there is even a remote chance of success. If history is to be any guide, the last time an adjustment burden fell onerously on Germany we had the global catastrophe called World War Two. Furthermore, I still see no evidence that fiscal unification will solve the underlying problems of structural unemployment across countries. I don't agree with the last assumption regarding China, but this summary is still pretty good and gets at many of the things I have been talking about on thses pages. Structual unemployment is addressed tangentially via union membership and expectations of income growth.

There is an old adage in forecasting that says -give a date or a number but never both.

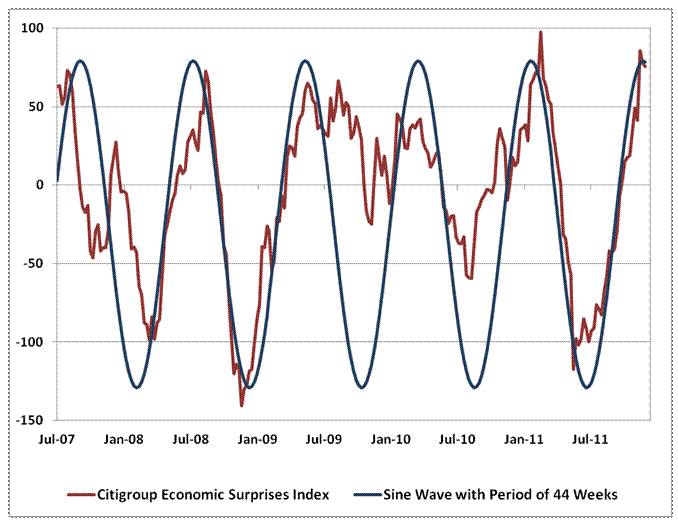

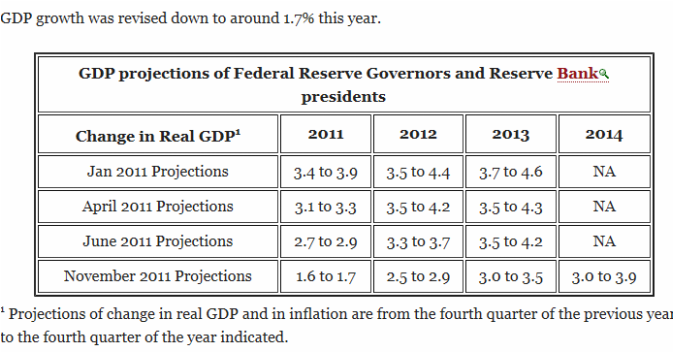

The current market expectations around the US economy are much too positive. I alluded to this in a post over a month ago. I have discussed the dismal state of Wall Street, IMF and FED forecasting on several occasions in these pages. These analysts: act as a herd, over rely on models, do not know how to think about systems, focus on the wrong data, and, as Hussman points out, exhibit binary thinking. From Hussman: More broadly, the real question is how much importance should we put on the fact that economic data has delivered consistent "positive surprises" in recent weeks? Don't all these surprises significantly short-circuit the risk of probable recession? On that question, the evidence is very clear. No, they do not. In order to properly understand economic "surprises," it's important to recognize that unlike actual economic data, where fluctuations have to do with, well, the actual economy, economic surprises are - by definition - measured relative to the subjective expectations of economists and Wall Street analysts. Unfortunately, analysts tend to be all-or-none. Instead of allowing for a normal ebb-and-flow of data, they form expectations that overshoot both on the pessimistic side and on the optimistic side. As a result, once the economy experiences an initial softening, expectations turn lower, often very aggressively. Over the following weeks, economic data can continue to be fairly soft, but because expectations have collapsed, the new data is interpreted as being "above expectations." After a while, that experience of positive surprises causes analysts to over-correct by forming overly optimistic expectations, which is predictably followed by a period where the data, unless it is spectacular, almost cannot help but disappoint. My observation is that this cycle of optimism and pessimism tends to run just over 20 weeks in each direction, though that is certainly not a magic number of any kind, and is best interpreted as a tendency. To give you an idea of how this regular pendulum of hope and despair affects the data in practice, the chart below presents the Citigroup Economic Surprises Index (a tally of how often recent economic reports have either beat or fallen short of consensus expectations). The blue line, to the thrill of anyone who enjoys Trigonometry, is a sine wave with a period of 44 weeks. “ (See Chart at end of post) So how would I do it better? Start by asking questions if your data or models or answers actually make sense given the broader context of what is happening. Start by asking yourself how bad things are going to get in Europe. Europe is going to have a strong recession. What’s more they are practicing austerity and have structural issues that prevent their economies from readjusting to sustainable growth path. I have heard remarked on business television that 40% of US corporate earnings are tied to Europe. At home, the states have a budget crisis and, at this writing, congress is struggling to pass a bill that extends the payroll tax holiday for only 60 days. Not to mention the US has its own structural employment issues. IMO, the only way the US can avoid a recession is if a stimulus package is passed. What are the odds of that? How big will it be, when will it get implemented? The problem in forecasting is not when you expect growth to be 3.7% and it turns out to be 3.3%. The problem occurs when growth is 1.7%. Just look at the embarrassing forecasts put out by the FED this year that typify the stupidity of mainstream analysis.(See second graph at end of post) As my Econometrics professor was apt to say: “Monkeys can run regressions.” Thinking about and understanding the context of data that is another matter entirely. This is a rarity in the professional economist community.

In August, I published a post on how the idea that economic growth of the BRICS can decouple from the global economy is a fantasy. Now, as I predicted, we see India is beginning to decelerate.

From 'The Economist': :"EXPECTATIONS for India’s economic growth rate have been sliding inexorably. In the early spring there was still heady talk about 9-10% being the new natural rate of expansion, a trajectory which if maintained would make the country an economic superpower in a couple of decades. Now things look very different. The latest GDP growth figure slipped to 6.9% and industrial production numbers just released, on December 12th, showed a decline of 5.1% compared with the previous period, a miserable state of affairs. The slump looks broadly based, from mining to capital goods, and in severity compares with that experienced at the height of the financial crisis, in February 2009, when a drop of 7.2% took place. Bombast is turning to panic. " Good luck cheerleaders. However, the price of oil seems higher than warranted given global economic activity. This remains a mystery to me. Supposedly, SA recently decided to increase output to 10 million barrels a day.

I am with this guy: “We doubt that Saudi will risk over-supplying the market, thus we are circumspect as to the announced 10 million barrel-a-day number,” said Harry Tchilinguirian, BNP’s head of commodity markets strategy in London. “Equally, if you look at International Energy Agency estimates for Saudi production going back to 2000, the kingdom has never produced 10 million barrels a day, and under the current market circumstances, a sudden and large jump in production relative to October levels appears counter-intuitive.” Any viable plan to save the Euro zone must be able to demonstrate how these economies are going to grow their private sector economies internally and generate job growth. Trade, the twin sister of financial inflows, will necessarily become a minor driver to most of these economies. Trade policy however will be vital. So when you hear the next load of daily BS, fed to you by the MSM, from the Eurocrats - ask yourself what are the portugese/spanish/italians/greeks/irish going to produce (more productively) under this new plan?

If they (you) can't answer this question, then you know it is just more of the same nonsense they have been feeding you. Until then 'don't trust the system'. Last summer, US Attorney General Eric Holder, publicly implored the creators of ‘The Wire’ to make one more season of the ground breaking series. David Simon, one of the creators, responded that they would be more than willing to do so if the US ended its ‘War on Drugs’. Translated: Since you haven’t learned the lessons from the earlier seasons, why should we teach you

others? One of the most important economic lessons taught by ‘The Wire’, and the theme of its second season, is structural unemployment. Structural unemployment is the type of unemployment that arises when there is a mismatch between the skills required by the jobs the economy generates and the skills of those in the workforce. The biggest issue in the global economy is the structural unemployment of low skill workers that has resulted from liberalized trade with the developing world, particularly China, in the last decade. It is a Trojan horse economic issue, because it is a stealth issue that is threating to destabilize western economies. In season three of ‘The Wire’, a police Major of the western district goes “rogue”, and decides to decriminalize (allow the free trade of) drugs as long as they are sold in sanctioned areas that are surrounded by the police. A sergeant policing one of the decriminalized areas, christened “Hamsterdam”,notices that social unrest and robbery begin to arise from the unemployed youth who formerly served as lookouts in the drug trade. The sergeant recognizes that this structural unemployment could destabilize the entire zone; he “taxes” the drug dealers, uses some of the money to provide services to the unemployed, the rest to provide income support and order is restored. The US has lost over 8 million jobs in manufacturing since China was allowed entry in the WTO, in Sept. 2001, and continues to lose thousands more manufacturing jobs every month. Youth unemployment in Europe is unsustainably high and growing. Would that Obama’s economic team, congress, as well as the European elites could integrate the lessons of ‘The Wire’. Until they do, expect economic instability and social unrest to continue to ratchet up. Perhaps David Simon's next series will be called 'The Noose' about how, given enough rope, the elites of the west managed to hang themselves. |

Categories

All

Archives

November 2017

|

RSS Feed

RSS Feed