|

Bass, like PM Harper, thinks Trump is going to push back hard on China wrt to trade.

0 Comments

Business Insider (Thanks Brent)

BEIJING — China said on Monday it expected to lay off 1.8 million workers in the coal and steel industries, or about 15% of the workforce, as part of efforts to reduce industrial overcapacity, but no time frame was given. It is the first time China has given figures that underline the magnitude of its task in dealing with slowing growth and bloated state enterprises. Yin Weimin, the minister for human resources and social security, told a news conference that 1.3 million workers in the coal sector could lose jobs, plus 500,000 from the steel sector. China's coal and steel sectors employ about 12 million workers, according to data published by the National Bureau of Statistics. Compares China with Russia.

FT (Thanks Michael Lim)

In a China-watching community where those at the extremes — “maximum” bulls and “coming collapse” Cassandras — often make the most noise, Jonathan Anderson at the Shanghai-based Emerging Advisors Group has long been regarded as one of the most thoughtful analysts. For years he laid out a convincing case for cautious optimism on the Chinese economy, but not any more. “For years we have been waiting for China to make the tough choice and sacrifice near-term growth in order to stabilise macro balance sheets and stop its exploding debt cycle,” he wrote on January 4, the first day of this month’s market and currency mayhem. “[But] the costs of taking real adjustment are clearly too high for the government to bear . . . Right now we put the initial potential crisis threshold at around five years.” Bloomberg

“I didn’t know it would be like this,” says 22-year-old Dang Lirong as she searches job postings for anything related to medicine at a Beijing employment fair. “I took the major because I thought it would give me a good job,” Dang says, adjusting her black-frame glasses. After four years of toil at college in Hebei and a year interning at a Beijing hospital, she has yet to land full-time work. Dang is among 7.5 million college graduates entering China’s job market this summer, the most ever and almost seven times the number in 2001. Their dreams are colliding with an economy growing at the slowest pace in a generation, adding pressure on policy makers to spur the employment-intensive services sector. “Every year it’s the most difficult job-seeking season for graduates in history, and the next year is even more difficult,” said Xiong Bingqi, deputy director of the 21st Century Education Research Institute, a Beijing-based think tank. “The services sector isn’t developed enough to create enough effective demand for college grads.” Compounding the challenge is a yawning skills gap between what the economy needs and what graduates want to do. The country’s services and innovation-led new economy is doing better than the polluting heavy industries of old, but they’re not expanding quickly enough to absorb the swelling ranks of aspiring attorneys, biologists and other young professionals. Graduates last year most wanted to be secretaries, teachers, administrators, accountants and human resource managers, yet the top five needed by employers were salesmen, technicians, agents, customer service staff and waiters, according to a 2014 report from Peking University and the website ganji.com, which helps companies to hire. The irony for China’s youth: the more educated you are, the tougher it is to find work. The unemployment rate for 16 to 25 year olds with a college degree or better was 5.6 percent in the first quarter, compared with 4.7 percent for those who didn’t finish high school, according to Gan Li, director of the Survey and Research Center for China Household Finance and a professor at Southwestern University of Finance and Economics in Chengdu. Jobs Mismatch“Only when more high-end services jobs, especially those in research and development, are created will the college employment problem be solved,” said 21st Century Education’s Xiong. China needs to further open the state-controlled media, telecommunication and finance sectors to absorb more educated workers, he said. Virtual World’“College students these days just want to sit in front of a computer, working and living in a virtual world,” she said, having collected fewer than 10 resumes in four hours working her booth. “They should come to companies like ours and do a job that communicates with people, real people.” Twenty-two-year old Guo Rui is among those who have bent the dreams of youth to match economic reality. After studying television production and working short stints at TV stations and newspapers, she ditched plans for a life on screen because the pay just didn’t cut it. She now works as a property sales agent in Beijing, earning about 20,000 yuan a month. “You can’t settle for what’s stable and comfortable when you’re young,” she said. “You should follow the market.” Seems to me that reforms are a power consolidation that picks winners and losers (like Putin did) and creates an shrunken oligargy loyal to Xi Jinping. I would therefore expect in the long run Chinese GDP per capita to converge to Russia's not South Korea's or Japan's.

From Bloomberg. (Thanks Michael) President Xi Jinping’s overhaul of China’s energy industry took a step forward as PetroChina Co. announced plans to unload $2.4 billion in Central Asian pipelines. The country’s biggest energy producer will sell a 50 percent stake in Trans-Asia Gas Pipeline Co. to a unit of China Reform Holdings Corp., another state-owned company that acts as an investment firm charged with revamping government-run entities. Trans-Asia Gas Pipeline operates a 1,830 kilometer (1,140 mile) system that carries gas through Turkmenistan, Uzbekistan and Kazakhstan to China’s far western province Xinjiang. China Reform was set up in 2010 by China’s State-owned Assets Supervision and Administration Commission, an arm of the cabinet that controls the biggest government enterprises. It agreed last year to help restructure the coal-to-chemical business of Datang International Power Generation Co., bought 6 percent in China Tower Corp. earlier this year and has taken over some smaller state enterprises. “We think this is a clear signal that China is more likely to establish a ‘National Gas Pipeline Entity’ to administer all the backbone pipeline assets,” Morgan Stanley analysts including Andy Meng said in a research report Thursday. From Quartz

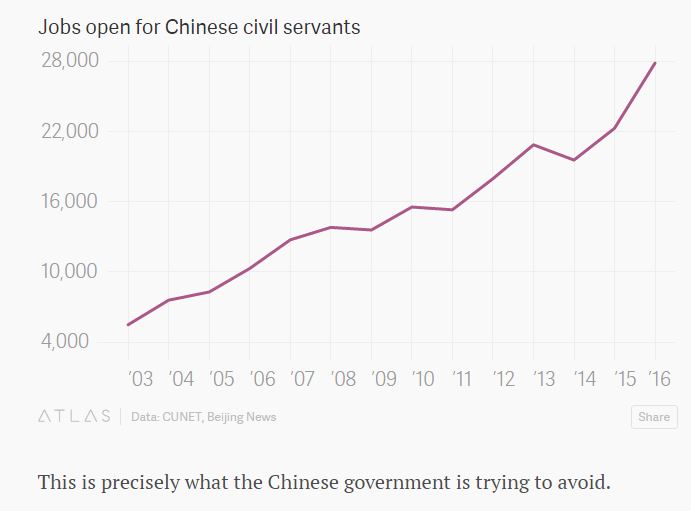

Since the eighties, the Chinese central government has called for lower-level bureaus to reduce their headcount. But these cries for reform have seldom yielded the desired result. Because officials seldom get fired, older or incompetent ones typically are moved laterally but kept on the government’s payroll. As new officials are hired to take their place, the system gets larger, more expensive, and less efficient. It is likely that applicants have stagnated, despite a dearth of good jobs for university graduates, because becoming a Chinese official has become a lot less cushy in recent years. Eswar Prasad, by his own telling, is a little more of a short term optimist and a little more of a long term pessimist on China due to his recent visit and observations.

|

Categories

All

Archives

November 2017

|

RSS Feed

RSS Feed