From US News & World Report:

"The Fed is running out of options however, as Bernanke himself implicitly acknowledged in his recent Jackson Hole speech. "Most of the economic policies that support robust economic growth in the long run are outside the province of the central bank," he reminded a worldwide audience.

Bernanke also emphasized that the imperatives of short-term stimulus and long-term fiscal discipline “are not incompatible.” "

Whether congress will take heed of this inuendo and pass a stimulus package is very much in doubt.

What’s more after having watched Japan struggle for more than a decade after their real estate driven financial crisis it is curious that respectable Economists are arguing against government stimulus at this time.

Chicago’s John Cochrane (2009):

“First, if money is not going to be printed, it has to come from somewhere. If the government borrows a dollar from you, that is a dollar that you do not spend, or that you do not lend to a company to spend on new investment. Every dollar of increased government spending must correspond to one less dollar of private spending. Jobs created by stimulus spending are offset by jobs lost from the decline in private spending. We can build roads instead of factories, but fiscal stimulus can’t help us to build more of both. This is just accounting, and does not need a complex argument about “crowding out.”

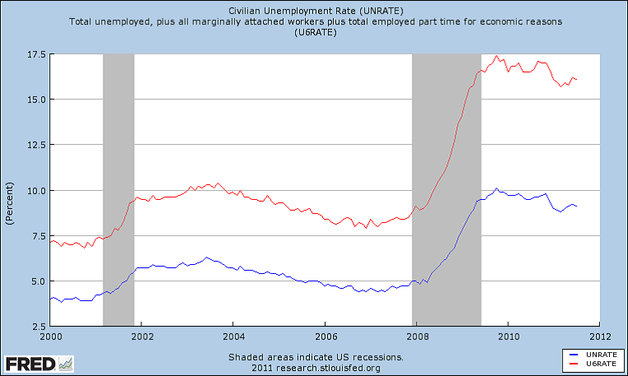

Really? Really, with official unemployment above 9.0%? It is fair to argue about the composition and efficacy of stimulus and that not all stimulus is equally expansive; but to say it is not needed after having recently witnessed Japan’s struggle is indefensible.

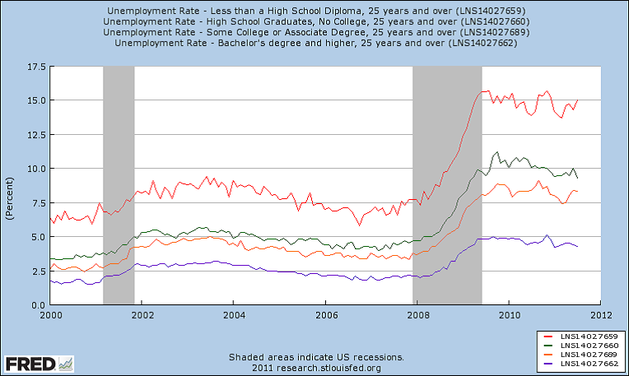

Monetary policy cannot solve all problems; we have to rely on the wisdom of Keynes to get us through this moment. Moreover those that say block grants to states are ineffective because they create no new jobs are missing the point - they preserve existing jobs. To get a terrifying view of the implications of state budget crises watch Bill Gates presentation on TED. Punchline: in order to balance state funding going forward education funding will have to be cut by 50%. Only one state in the union does not have a balanced budget amendment. When Argentina went through difficult financial times one province shut the public school system for a year. Is that where the US is heading? And what does this say about its ability to compete in the future?

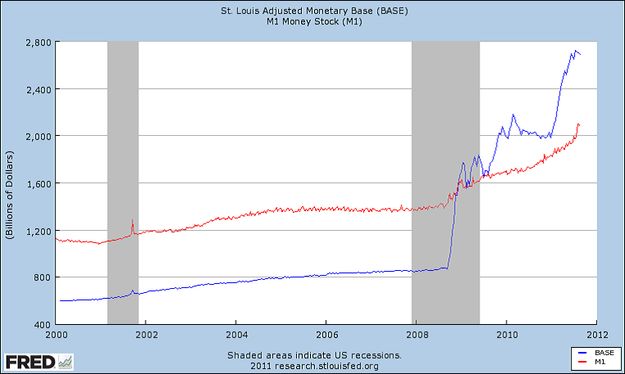

Finally, Richard Koo does a great job of highlighting, on slide 36, why Cochrane's crowding out senario would be appropriate if this were a conventional post recession recovery - not one prompted by an asset bubble. In the current situation, monetary policy is ineffective, argues Koo, and fiscal stimulus is appropriate.

In economics, as in scripture, as in life, dragons exist - the appropriate way to kill them depends on the situation.

RSS Feed

RSS Feed