Senior debt via CBC

Food banks in Alberta via CBC

Consumer bankruptcies on the rise

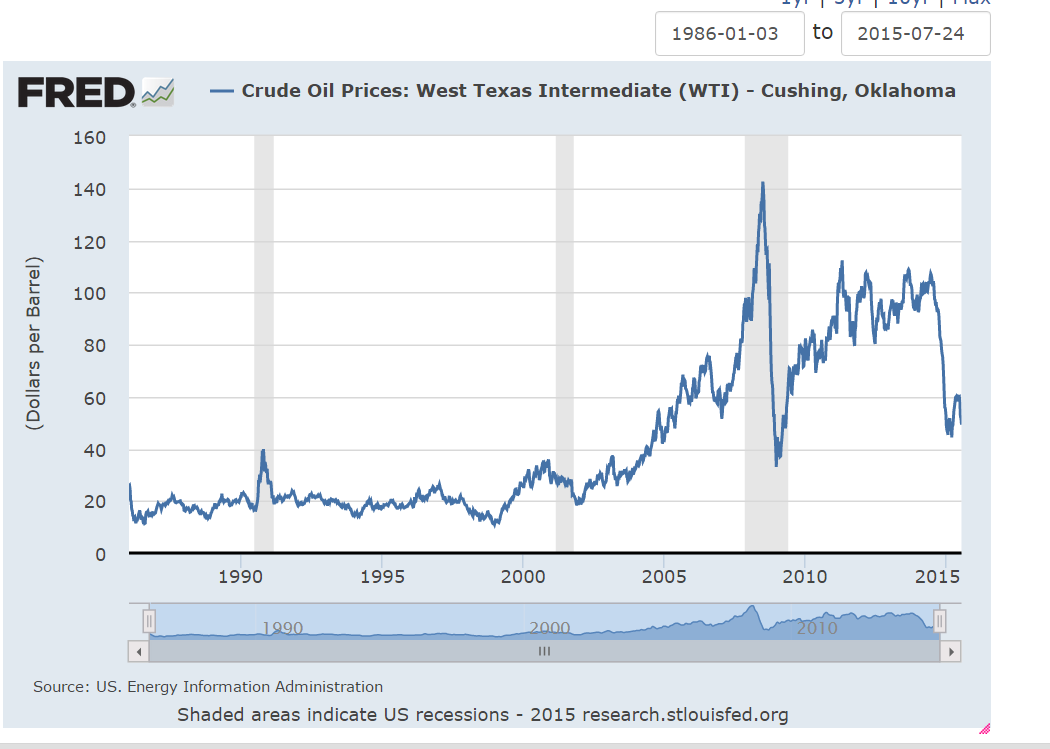

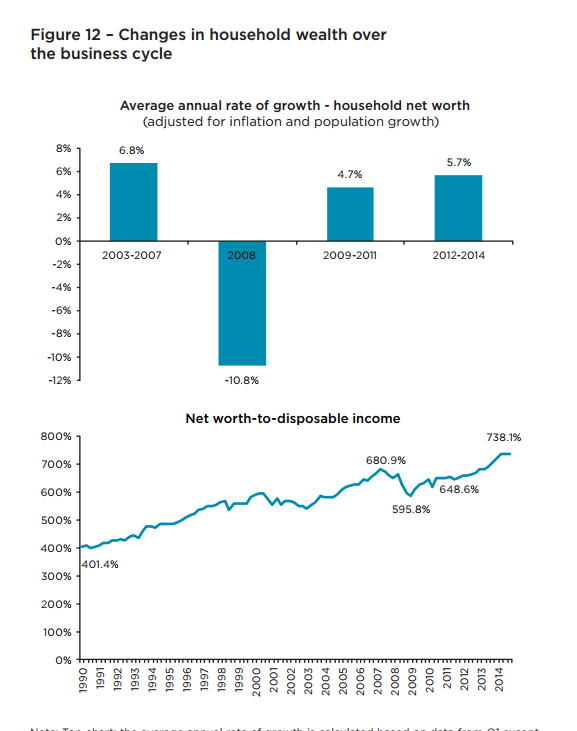

Our conclusions include the following: Households’ perceptions are not responsive to signs indicating a possible deterioration in the economic environment; however, households are aware of their susceptibility to specific negative financial shocks. A number of recent developments suggest a possible deterioration of Canada’s economic prospects; those include the decline in international oil prices and Bank of Canada’s target interest rate. However, households outside Alberta did not view these changes as having the potential to affect their financial wellbeing:

• Nearly half (49%) of households said these changes would not have a noticeable impact on their financial wellbeing over the next 12 months.

• In total, 34% of households said the changes in oil prices and interest rates were likely to prompt them to decrease their current pace of savings, while 22% thought they were likely to borrow more than was initially planned as a result of the shift in economic conditions.

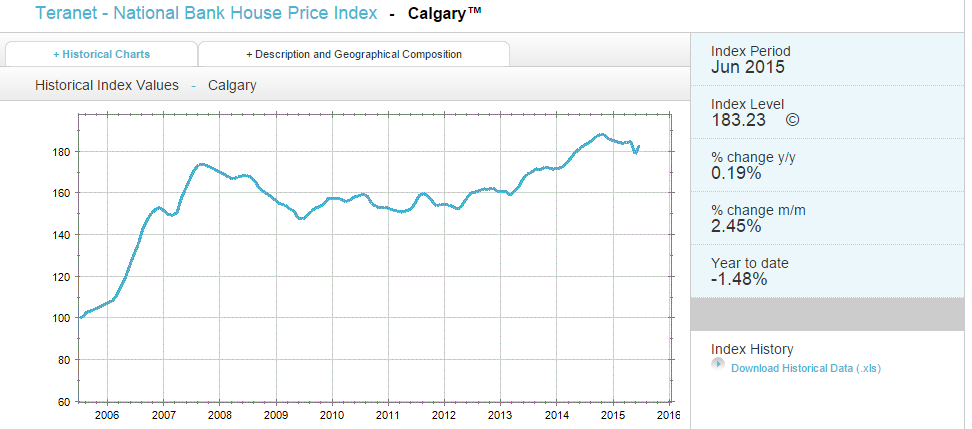

• Further, households that reported having no wealth were much more likely to say that the changing economic environment would prompt them into more extensive borrowing and lesser effort of saving. While providing substantive insight into provincial or regional differences is difficult without a deeper level of data, it is clear from the survey results that households in Alberta are different than in the rest of the country, likely because Albertans will be more directly affected by the recent decline in oil prices. While only 16% of Canadians surveyed expected a negative change in their financial situation because of changes in the economic outlook, 34% of Albertans expected to be negatively affected by such change.

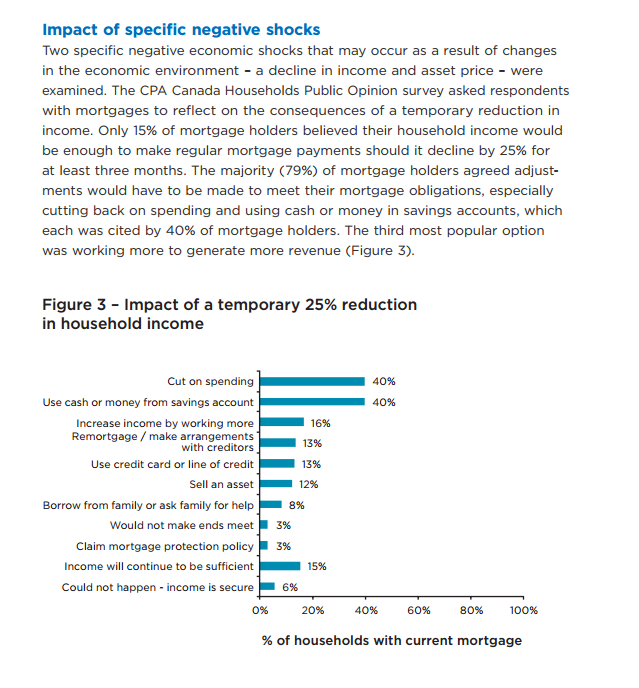

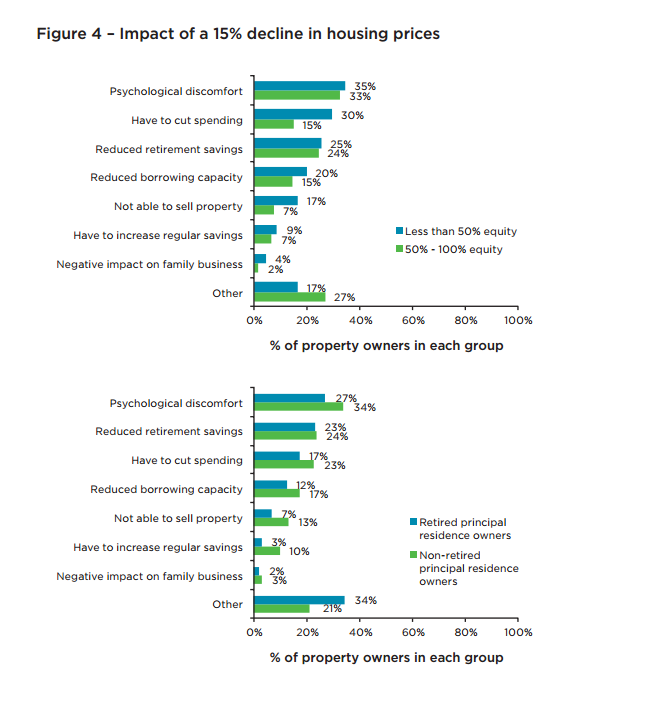

Our primary finding is supported by evidence that the behaviour and attitudes of households has changed very little in the face of the change in economic outlook and the increased uncertainty since mid-2014. A comparison of the results from the two waves of CPA Canada’s Households Public Opinion survey—spring of 2014 and winter of 2015—suggests that households did not noticeably change their approach to managing finances in light of the shifting economic conditions and the attention drawn to those developments by various observers. By comparison, when asked how they would react to a specific, quantifiable economic shock, households showed both understanding and the willing to take appropriate financial measures to protect their wealth.

For example:

• Seventy-nine per cent of mortgage holders agreed they would have to make adjustments to meet their mortgage obligations should their household income decline by 25% for at least three months. Forty per cent of mortgage holders said they would have to cut back on spending and the same percentage said they would have to use cash or money in savings accounts to ensure mortgage obligations were met.

• All property owners felt that a 15% decline in housing prices would be associated with some negative consequences in addition to psychological discomfort. Twenty-four per cent of property owners said the decline in housing prices would reduce their retirement savings, while 21% thought they would have to cut spending. The perceived impact of the price decline was greater for non-retired households and those with lower levels of equity in their homes.

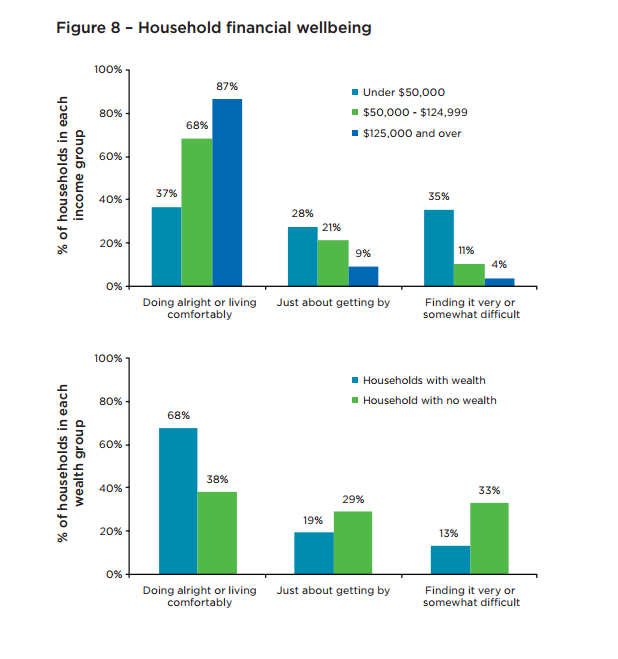

While Canadian households rate themselves highly in terms of financial discipline, not many households are paying attention to signals of potential economic weakness and are taking measures that could help mitigate financial vulnerability. A total of 65% of Canadian households assessed the level of their financial discipline as somewhat or very strong.

However: • Only 60% of households with debt said they paid off a portion of their outstanding debt on a regular basis (weekly, bi-weekly, monthly, etc.)

. Forty-one per cent of households with home equity lines of credit (HELOCs) did not make regular payments that covered both interest and principal to repay the outstanding balance.

More than half (53%) of non-retired households said they did not save on a regular basis and 30% of households reported that they had no wealth.

• Few households said they kept themselves well informed regarding the value of their wealth: 25% had either never calculated their wealth or last calculated it about a year or more ago; as many as 20% of those surveyed did not remember when their household last assessed the value of its wealth.

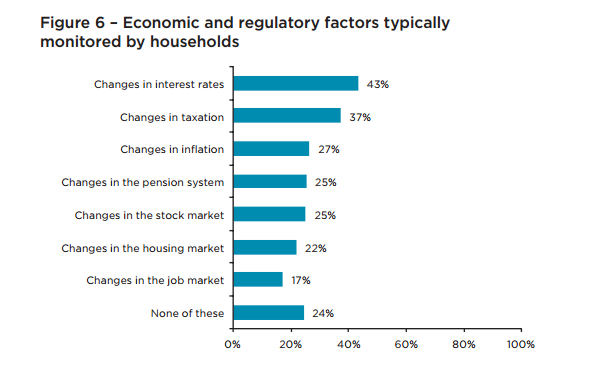

• Few households monitored changes in external economic and regulatory conditions; 24% of households said they did not usually watch the key external factors that could affect their financial wellbeing.

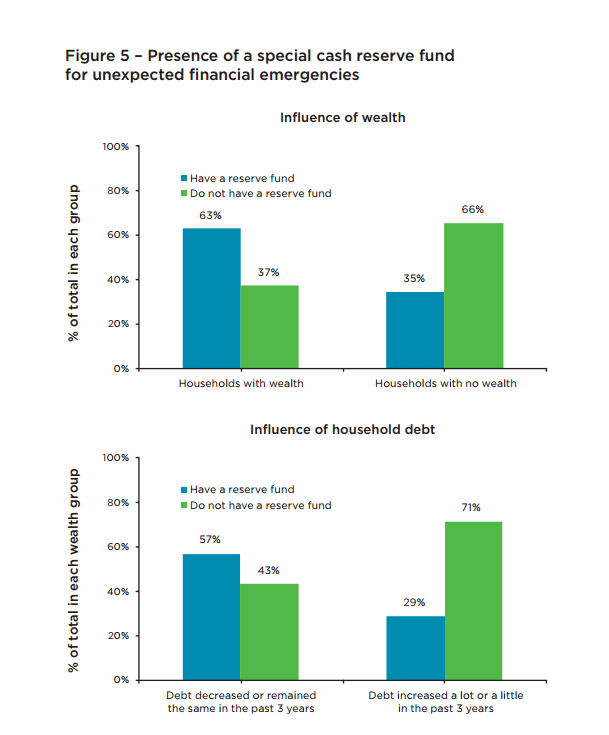

• A full 51% of non-retired households said they did not have a special reserve fund for unexpected financial emergencies. About a fifth of those who had such a fund said that the emergency savings would allow their household to cover regular expenses for no longer than four weeks.

RSS Feed

RSS Feed