"Germany’s exports are falling at the fastest rate since the global crisis in 2009, raising fears of a triple-dip recession and a disastrous relapse for the rest of the eurozone.

Christine Lagarde, the head of the International Monetary Fund, warned that the eurozone is at “serious risk” of falling back into recession if nothing is done, and is in danger of suffering a lost decade. “If the right policies are decided, if both surplus and deficit countries do what they have to do, it is avoidable,” she said. The wording is a clear call to Germany for an immediate shift in policy.

The ECB warned in its monthly report that the eurozone jobs market has failed to recover as expected, with the numbers out of work for 12 months or longer still rising. “It warrants particular attention from policymakers as it points to an elevated risk of a marked increase in structural unemployment across the euro area, and potential hysteresis effects,” it said. In technical terms, it said there had been an "outward shift in the Beveridge Curve".

The bank said structural unemployment has jumped to 10.3pc and is worst in some of the crisis countries forced to shake up their labour markets. While couched in cautious language this is an admission that the supposed cure of “labour flexibility” imposed by the EU on southern Europe is not working as hoped, and may stem from a false diagnosis of Europe’s jobs crisis. It called for retraining and other “active labour market policies” to bring millions of marginalised people back into the workforce. This is exactly what critics have been saying all along."

Deflationary spiral risk increases

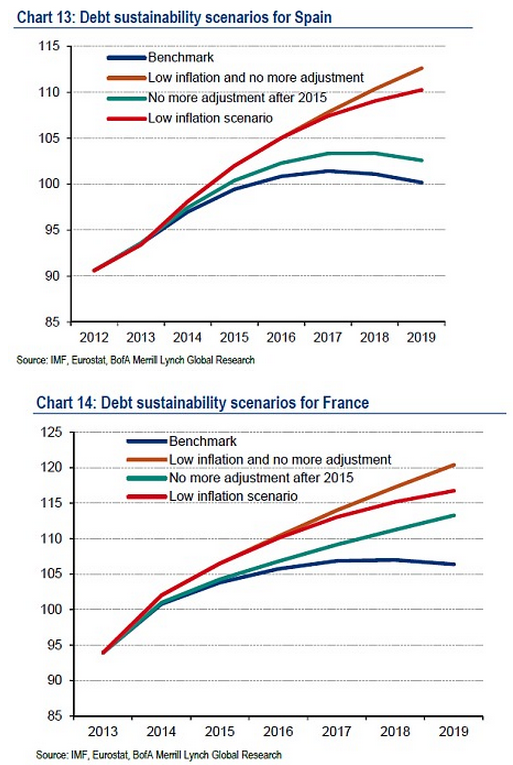

"Ruben Segura-Cayuela, from Bank of America, said low inflation has become “the biggest threat to the dynamics of public debt” in the eurozone, warning that debt ratios risk “spiraling up” even at levels of around 0.5pc."

I love how the "Benchmark" scenarios all have gdp debt levels leveling off and declining in about 5 years. What a joke.

"Analysts are watching German politics just as closely as ECB language. The rise of Germany’s AfD anti-euro party raises the political bar even further for full-fledged QE, and eurosceptics have announced their intention to file cases at the German constitutional court to block asset purchases once they begin.

The court has already ruled that the ECB’s backstop measures for Italian and Spanish debt (OMT) “manifestly violate” the EU Treaties and are probably “Ultra Vires”, which prohibits the Bundesbank from taking part. Pending cases on QE would raise questions over whether the Bundesbank might have to step aside on asset purchases.

The current circumstances are very different from July 2012, when Mr Draghi had the full political backing of the German finance ministry for his OMT rescue plans. This time he must battle critics across the whole political spectrum in Germany.

Giulio Mazzolini and Ashoka Mody, from the Bruegel think tank in Brussels, said the eurozone seems to be tipping into a “debt-deflation cycle” as rising debt and deflation feed off each other, yet the authorities remain paralyzed and still refuse to face up the gravity of the threat. “Even now, ECB officials regard deflation to be unlikely,” they said."

RSS Feed

RSS Feed