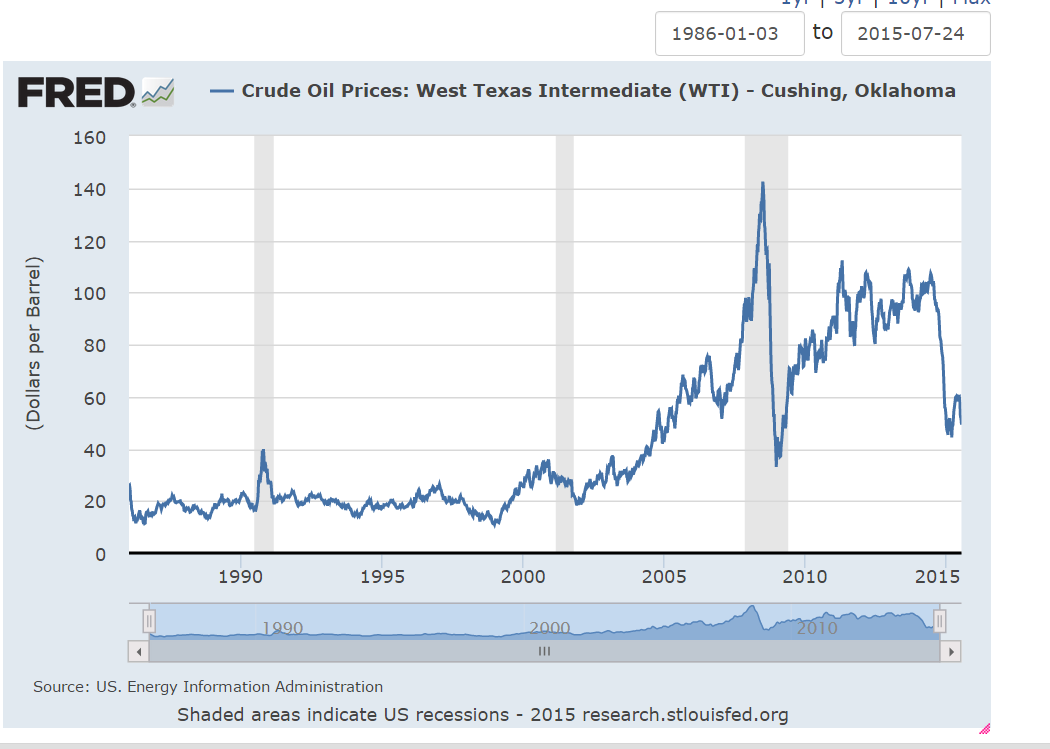

Bank of Canada Governor Stephen Poloz is warning that the oil price shock could weigh on Canada’s economy for at least another two years.

The central bank kept its key overnight lending rate unchanged at 0.5 per cent Wednesday, after cutting it twice this year.

But the bank downgraded its economic outlook for next year and 2017, citing a “complex” transition away from the once-booming resource sector.

After flirting with a recession earlier this year, the Canadian economy will grow just 2 per cent in 2016 and 2.5 per cent in 2017, the bank said in its latest monetary policy report. That’s down from previous forecasts of 2.3 and 2.6 per cent, respectively.

Low oil prices are continuing to sap business investment and put a dent in the value of Canadian exports, overwhelming some of the improvements elsewhere in the economy. The bank now expects spending in the energy sector to drop another 20 per cent in 2016, after a 40-per-cent drop this year.

Mr. Poloz said it will take up to two years for the recent rate cuts to work their way through the economy. “We need to be patient and let monetary policy do its work,” Mr. Poloz told reporters in Ottawa.

And he pointed out that the non-energy side of the Canadian economy is gaining steam, buoyed by those lower interest rates and the cheaper Canadian dollar.

Vast swaths of non-energy exports are in full recovery mode, according to a separate analysis of more than 4,000 exports, also released Wednesday by the bank. Exports of hundreds of items, including building products, aerospace and fabricated metal, have grown by at least 10 per cent a year since the recession.

More worryingly, the Bank of Canada warned that the potential growth rate of the economy may be weaker than expected because of “capacity destruction,” some of which may never come back. The result is that the potential growth of the economy is “likely to be in the lower part of estimates” this year and next.

RSS Feed

RSS Feed