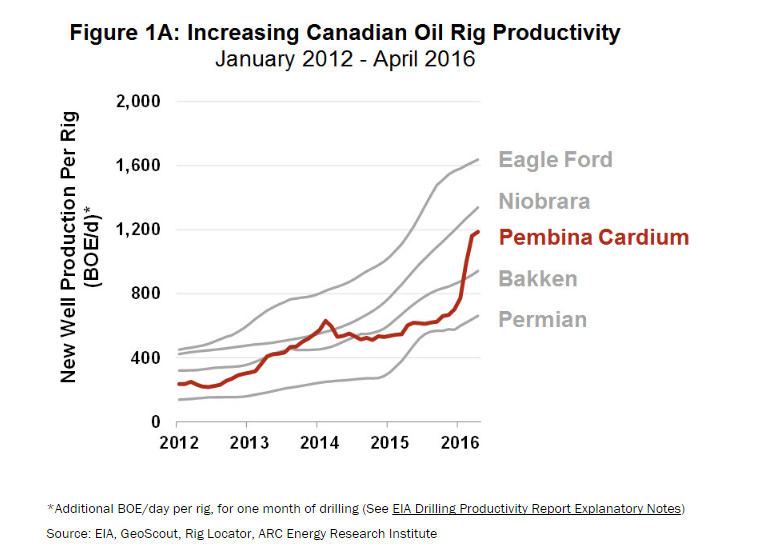

Examining the headline plays in the United States, the amount of oil and associated gas that can be brought out of the ground with the grinding pipes and bits of one rig has increased in the range of four-fold since 2012.

Take for example the oil-soaked Permian Basin in Texas. Back in 2012 a rig working in the region for one month could drill enough rock to add 150 BOE/d of average production. Four years later the output from one drilling rig was over 600 BOE/d. In the prime postal codes of the Eagle Ford, the rates are over 1,600 BOE/d! No wonder the OPEC-and-friends cartel is concerned about what’s happening on this side of the world.

The reasons for the productivity improvements are many: Drilling faster and more accurately; employing new-age, alternating-current (AC) electric rigs; migrating to development drilling on multi-well pads; using rigs that “walk” and move quickly from one location to the next; high-grading of prospects to the best areas; and realizing learning-curve effects from completion technologies that are leading to more production from each well. .....

............

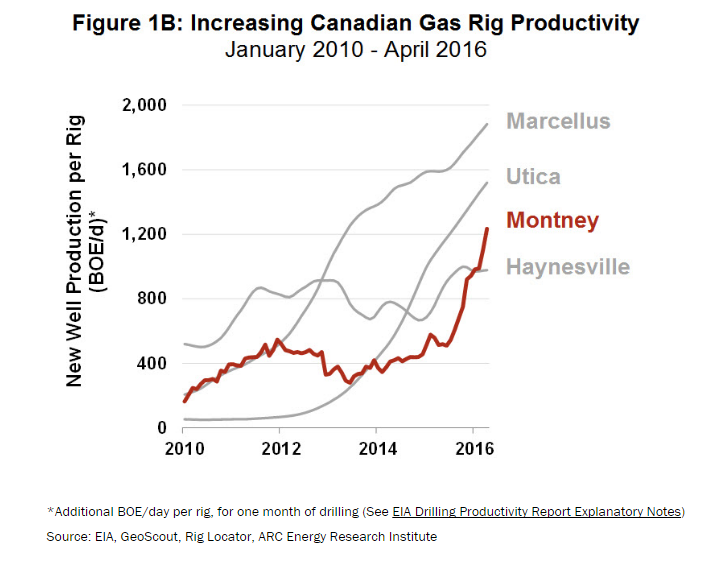

It’s early days yet. Productivity gains have been impressive in a short period of time, in select areas of the vast WCSB. Learning curve effects are just starting to kick in, so the reserve and production potential of natural gas and low-carbon liquids in the wider WCSB is looking promising.

In past columns I’ve made the claim that the recent upturn in the Canadian oil and gas industry – increasing capital expenditures and rig counts – is being driven by innovation, efficiency and speed to market. The Canadian rig productivity data helps to validate that claim, and explains the shift in investment emphasis away from the oil sands toward resource plays in Saskatchewan, Alberta and BC.

RSS Feed

RSS Feed