Many say strong immigration numbers are supporting growth. Your take?“Immigration is fairly easy to counter. Canada has been a leader in immigration growth. But the second-fastest [market] was the United States, and they had a boom and bubble and huge crash. The foreign investor theme is somewhat different. As soon as there is a downturn in the market, they’ll look elsewhere. They’re not particularly tied down to Canada.”

What could cause the Canadian bubble to burst?“Two things. Interest rates rising. But that doesn’t look like it’s imminent. The more likely cause would be recession. Incomes would drop, and already Toronto is like six or seven times incomes [in average mortgage loan vs household income]. Some borrowers will get into the position where they can’t afford to keep the house they have.”

See also this article:

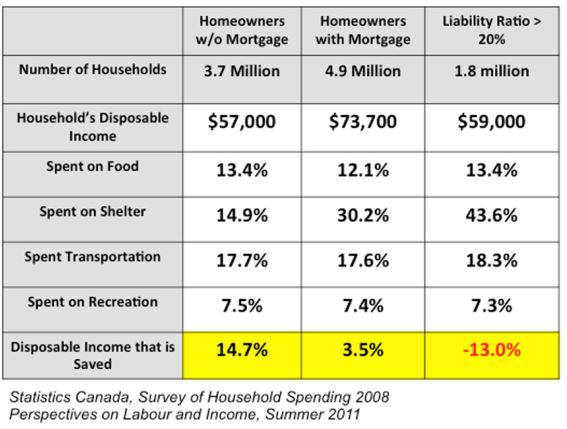

Now look at the third and final column in the table; the one I believe is the scary one. This summarizes the spending life of the 1.8 million Canadian households who have a mortgage liability ratio (MLR) larger than 20% of disposable income. Recall, this implies that they are spending at least 20% of their after-tax income to cover the mortgage (only). On a pre-tax basis this number is higher and this figure doesn’t include maintenance, property taxes, heating or utility bills and all the other things one needs to avoid freezing in the winter or melting in the summer. The 20% of disposable income (only) goes to keep the bank at bay.

RSS Feed

RSS Feed