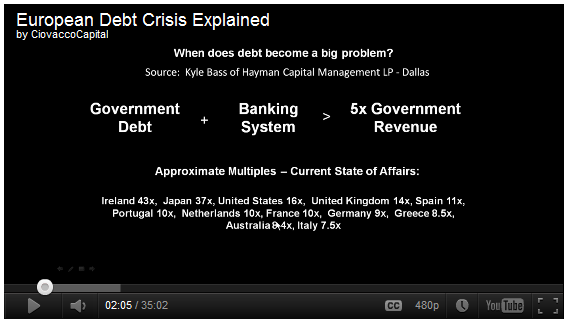

Much of the Euro zone, the US and Japan have unsustainable debt trajectories, on top of which they have banking systems which themselves are impaired with bad loans. Kyle Bass, hedge fund manager at Hayman Capital Management LP, calculates that when sovereign debt + size of banking system> 5X government revenues - the government loses the ability to bail out the banking system.

The question for the individual investor, risk manager and portfolio manager is which market effect is likely to dominate? Deflation is bad for commodities like gold but good for US treasuries, vice versa for inflation.

Moreover, as was the case last fall, it isunlikely that all countries would have uniform responses. For example, debt restructuring could dominate the Euro zone and the US response could be inflationary. Ray Dalio, of Bridgewater Associates, also sees a non-uniform response.

"Dalio believes that some heavily indebted countries, including the United States, will eventually opt for printing money as a way to deal with their debts, which will lead to a collapse in their currency and in their bond markets. “There hasn’t been a case in history where they haven’t eventually printed money and devalued their currency,” he said. Other developed countries, particularly those tied to the euro and thus to the European Central Bank, don’t have the option of printing money and are destined to undergo “classic depressions,” Dalio said.

We are in a new age of volatility. The central banks, particularly the FED, have been managing the market levels, providing accommodation that may have short term benefits but serves to increase systematic risk and volatility in the economy. This means all asset managers are now risk managers.

RSS Feed

RSS Feed