|

Business Insider quotes some Goldman Sachs research that suggest the re balancing may be on its way. (Hat-tip Brent)

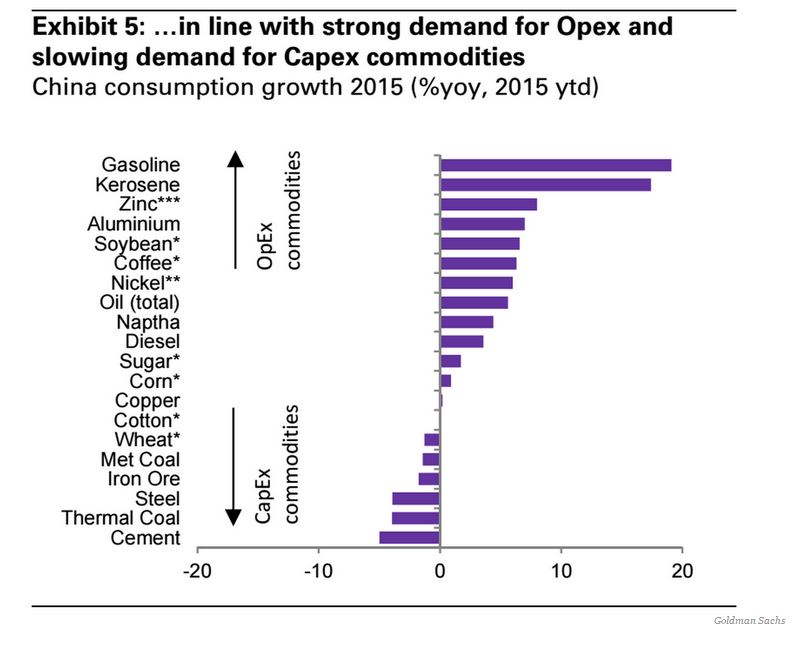

"In China, consumption of capex commodities is slumping, against rapid growth in opex commodity consumption. The more capex-intensive the commodity, the weaker the demand growth, while the more opex-intensive the commodity, the stronger the demand growth. Demand has declined by 5.0% for cement, yet demand for gasoline is up 19.1%. This pattern suggests that policymakers are, at least to a degree, successfully creating the conditions for the much-anticipated rotation in economic growth away from investment and towards consumption. And that's pretty important. Beijing is currently trying to rotate away from being the world's investment-heavy, export-driven industrial powerhouse and towards an economy more driven by domestic consumption and services. That's how the country will stop itself getting stuck inthe middle income trap — policymakers hope. " Once again

The Telegraph AEP With hindsight it is clear that the world economy came within a whisker of recession earlier this year. Global shipping volumes contracted by 3.4pc between January and May, according to Holland’s CPB world trade index. This episode is now behind us. Leading indicators and monetary data in the US, Europe and China point to an accelerating rebound over coming months. Gabriel Stein, from Oxford Economics, says the growth rate of the world's real M3 money supply – based on the US, China, EMU, the UK, Japan and Canada – rose to a six-year high of 6.2pc in June. The M3 gauge tends to lead economic growth by 12 months or so, suggesting that the worst may soon be over. In Europe, the monetary kindling wood of recovery is clearly catching fire.Spain is growing at its fastest pace since the post-Lehman crisis. So is Ireland. The triple effects of quantitative easing by the European Central Bank, a 12pc fall in the trade-weighted index of the euro in 15 months and the fall in Brent crude prices from $110 to $50, have together lifted Euroland out of its six-year depression. The property slump is over. Standard & Poor’s expects house prices to rise 3pc in Holland, 4pc in Portugal, 5pc in Germany and 9pc in Ireland this year. keep going with QE until the end of next year,” he said. America is slowly weathering the effects of the strong dollar. The economy grew at a 2.3pc rate in the second quarter. Capital Economics expects it to accelerate to 3pc in the second half. Loans are growing at an 8pc rate. It is not a glorious boom, but nor is it the stuff of global meltdowns. The commodity crash may feel as if Armageddon has arrived but it is, in reality, the tail-end of China’s hard landing, compounded by Saudi Arabia’s political decision to flood the global crude market and strike a blow against Russia, Iran and the US shale industry. “There has been a sharp drop in the ‘commodity-intensity’ of China’s economic growth,” said George Magnus, a trade expert and a senior adviser to UBS. “This has sent very chilly winds through parts of the world. Vast swathes of the emerging market universe have lost their export prop." The synchronized rout that we have seen across the gamut of commodities – from copper, to thermal coal, soya and milk - is certainly hair-raising. The Reuters-Jeffrey CRB index of raw materials has collapsed by almost 60pc from its peak in 2008 and is back to levels first reached in 1971. There is a risk that this could go too far and metastasize, leading to a second leg of global deflation. This would play havoc with debt dynamics in a world where debt ratios have risen by 30 percentage points of GDP since 2008, reaching unprecedented levels. Yet commodity crashes are double-edged. They act as a stimulus for the world economy. The consuming nations are enjoying a $500bn "tax cut" from the OPEC cartel. The slide may soon touch bottom in any case, if it has not already done so. The Baltic Dry Index measuring freight rates for dry commodities has almost doubled since the start of June. The shipping firm Clarksons said it is being driven by a revival of Chinese steel demand. The chances are that the growth scare of 2015 will prove to be a false alarm, much like the nasty episodes of 1987 and 1998 when market tantrums – frightening at the time – turned out to be innocuous. The cycle had another two years’ life both times. Markets over-reacted violently this week to a fall in China’s PMI manufacturing gauge to 47.8 in July, fearing that the economy is now in the grip of such powerful debt-deleveraging that stimulus no longer works. But the survey was distorted by the immediate fallout from the stock market debacle in Shanghai. Nomura says its "growth surprise index" is signalling a “strong rebound” after touching the bottom in May. ...as their trade deficit narrows unexpectedly (by quite a bit indeed). How much Japanese adjustment will the world be willing to bear? I have many links on these pages that suggest QE is about competitive devaluation. Here are a couple.

I shared some of Zerohedge's views and similarly underestimated the ability of CBs/policy makers to kick the can down the road.

i would say that if the US isn't in a official recession by Mar. 2013 I will admit to being wrong. EU held up better (politically) than I thought it would -though economic performance was on par with my expectations. The bottom line is I have been expecting a syncrhonized crisis EU-US-China-Japan and so far the world has managed to muddle through. I still expect this to happen "soon". As an x-boss used to say about forecasting, give a date or a price - but never both. I still believe we are headed for soverign debt crisis which will rival or exceed the Great Recession. But........ May all my pessimistic forecasts be found to be tail events which never happen. Its been a good year for me personally. I thank the readers of this blog for their time and attention. Hopefully you have found something of value from my filters. Happy New Year. He cranks his rehtoric up on the likelihood of war.

Central Bank balance sheet expansion that goes on infinitely. Japan eventually defaults even though it is a soverign with its own currency. Here.

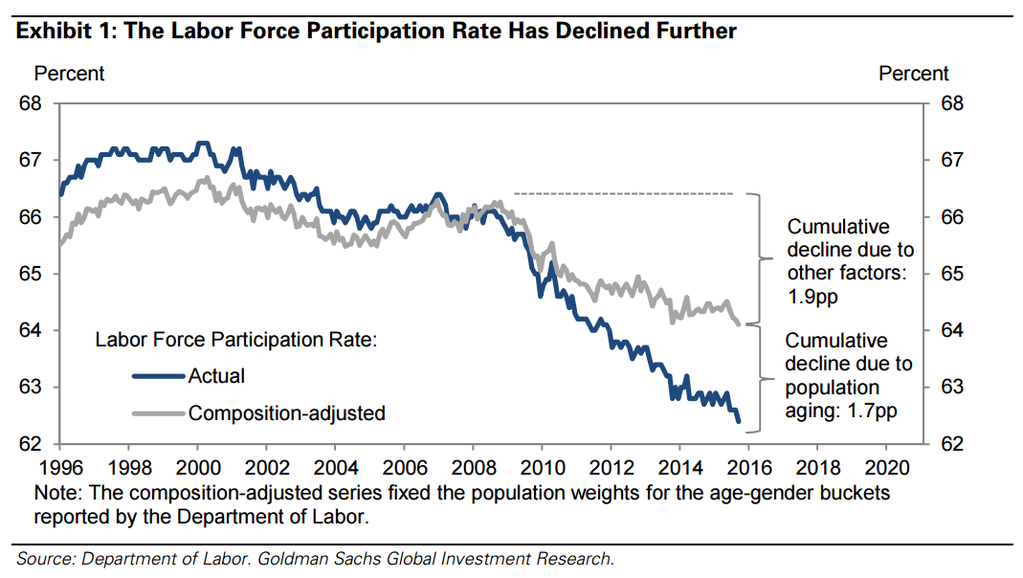

Kneel before your robot overloard. Technology marches on - routine jobs will continue to be eliminated. 60 Minutes just did a piece on the skills gap. There are unfilled jobs in manufacturing in America but they involve programing computers. The jobs profiled pay $12/hr in Nevada with benefits. Expect inequality, if left unchecked, to continue to increase.

Housing up for 6th month in a row and consumer sentiment up more than expected. But I am the Grinch that stole Christmas.

From Zerohedge: "The main reason for the surge in consumer "confidence" in September was the near record surge in sentiment for those aking $15,000-$25,000, which soared from 43.5 to 62.4 in the month, the most since April 2009. And whether this was due to their forecast of the future, and expectation that things will get much better, or not, we don't know, what we do know is that half all of those people whose sentiment defined the market tone today, and who may be quite instrumental in the outcome of the coming election (per Mitt Romney), have less than $100 in cash savings." From the Winnipeg Free Press (hat tip Mish): "Did you smile or cheer when U.S. Federal Reserve Chairman Ben Bernanke announced Quantitative Easing III (and the markets went up)? He just declared war on your job, and the whole Canadian economy. Of course, so did the European Central Bank, the central bank of the Peoples' Republic of China and others. All of them are engaged in the same practice. They're printing money. Gobs of it, in programs that have no end point. Some are doing it to apply stimulus to revive their economies. Some are doing it to play extend-and-pretend games to hold their banks together. For a country like Canada, with an economy in reasonably good shape, a government that's not out of control, banks that are healthy and dependent on exports, it's a declaration of war." Finally, what about yesterday's news that Germany looks like it is going into recession? How's France doing? How about Japan? On corrupt, eliteist wealth from the Book Of Mormon (Take that Mitt Romney) "In calling the Nephites to repentance, Samuel the Lamanite warned that "the time cometh that [the Lord] curseth your riches, that they become slippery, that ye cannot hold them; and in the days of your poverty ye cannot retain them" (Helaman 13:31). In that day the Nephites would lament, "We have hid up our treasures and they have slipped away from us, because of the curse of the land. O that we had repented in the day that the word of the Lord came unto us; for behold the land is cursed, and all things are become slippery, and we cannot hold them" (vv. 35-36)." Enjoy your day. |

Categories

All

Archives

November 2017

|

RSS Feed

RSS Feed