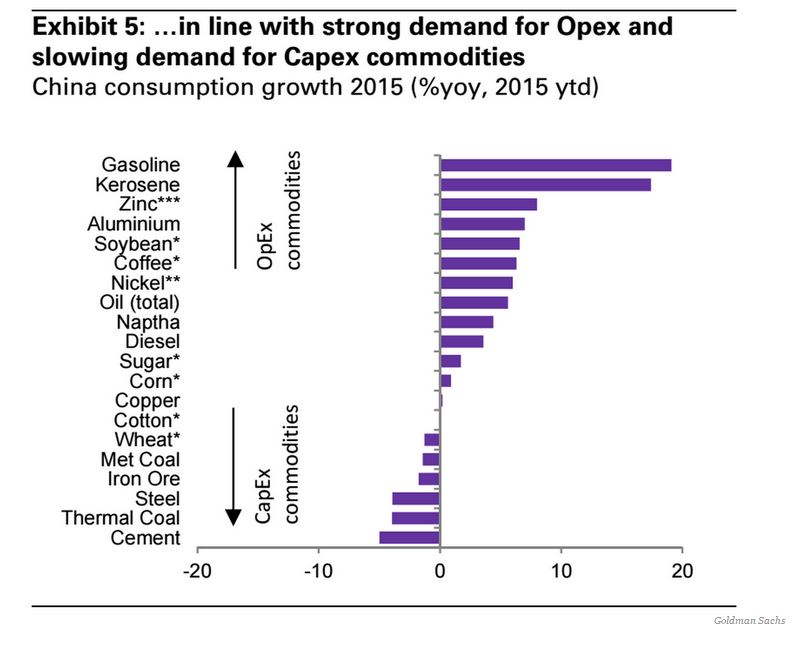

"In China, consumption of capex commodities is slumping, against rapid growth in opex commodity consumption.

The more capex-intensive the commodity, the weaker the demand growth, while the more opex-intensive the commodity, the stronger the demand growth. Demand has declined by 5.0% for cement, yet demand for gasoline is up 19.1%. This pattern suggests that policymakers are, at least to a degree, successfully creating the conditions for the much-anticipated rotation in economic growth away from investment and towards consumption.

And that's pretty important. Beijing is currently trying to rotate away from being the world's investment-heavy, export-driven industrial powerhouse and towards an economy more driven by domestic consumption and services. That's how the country will stop itself getting stuck inthe middle income trap — policymakers hope. "

RSS Feed

RSS Feed