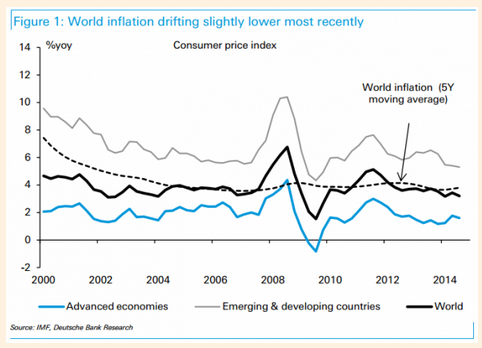

"Consider some of the global non-policy forces that might now be weighing on price inflation:

– Aging demographics, high debt loads, weak nominal wage growth and persistent output gaps in advanced economies.

– Slowing growth in emerging economies, as their catch-up period has stalled.

– The shale revolution and improving technologies across the energy landscape, along with weaker commodity price growth in recent years.

– Entrenched deflation in non-construction investment goods (and consumer durable goods) since the late 1990s.

– There continues to be a residual belief in most developed-world markets, resilient since the 1980s and the subsequent Great Moderation period, that central banks can reverse breakaway inflation. This makes it hard for inflation expectations, which can have a feedback effect on current inflation itself, from becoming too unanchored even if unexpectedly aggressive demand-side policies are pursued. (The same expectation of stability also probably helps prevent deflation.)

.......

Subdued inflation obviously isn’t a permanent state. Looking only at the broad global trends conceals tremendous variation between countries. Some economies are also more vulnerable to specific global pressures, and to currency fluctuations, than others. Domestic policy still matters most, and even when it is inadequately aggressive, plodding growth can still slowly lead an economy back towards full employment eventually, provided it goes on for a while.

But the problem that comes with running a low-pressure economy for too long is that the expansion stays precarious. Geopolitical (not to mention domestic-political) risks are always looming. The opening months of the year demonstrated that even the weather can knock the strengthening US economy off its growth path, if temporarily. Another slowdown in growth, or even a downturn, becomes more likely if negative cyclical forces reassert themselves. The same applies if measurement flaws lead policymakers to believe that their economies are stronger than they really are, prompting complacency. Finally, the delay itself is problematic given the possible hysteresis effects of people and capital going unused, lowering the slope of potential growth.

Look at the set of trends listed above, and you might recognise that many of them are diametrically the opposite of those that prevailed in the 1970s. A few of them are also quite obvious reversals from the decade leading up to the recent crisis. The point is not that policy can do nothing to countervail these global forces; it can do plenty. The point is simply that when the world changes, so does the mix of influences on price behaviour."

RSS Feed

RSS Feed