We did not get here by accident the US (and European) banking systems were left essentially insolvent as a result of the financial housing crisis of 2008. As the global credit markets froze up policy makers had two options. The first was to allow the banks to fail; shareholders get wiped out bond holders get converted to equity holders and the banks are recapitalized while the government g-tees deposits or temporary nationalization of the banks if necessary. This was the path chosen by Sweden when faced with a bank crisis.The alternative was to prop up the banks and allow them to grow into solvency by government and central bank support. This was the path chosen by Japan. From the perspective of most observers Sweden’s recovery was quicker and stronger than Japan's.

A policy decision was made at the time to follow Japan’s path; that the banks were too big to fail. TARP followed, as did accounting rules removing the requirement for marketed to market value of bank assets, free borrowing by banks from the FED, money paid by FED on excess balances and ultimately what has come to be known as “quantitative easing” a process where the central banks purchase the bad loans (toxic assets) from the banks to help shore up their capital base. The ultimate goal was to prevent a run on banks based on a loss of public confidence.

Having chosen the TBTF path, these actions are based on justifiable fears. In the “Great Depression” this there was a run on banks and deflation because of FED inaction.

http://elsa.berkeley.edu/~cromer/great_depression.pdf

An exccerpt:

“The Federal Reserve did little to try to stem the banking panics. Milton Friedman and Anna J. Schwartz, in the classic study, A Monetary History of the United States, argue that the death of Benjamin Strong, the governor of the Federal Reserve Bank of New York, was an important source of this inaction. Strong had been a forceful leader who understood the ability of the central bank to limit panics. His death left a power vacuum at the Federal Reserve and allowed leaders with less sensible views to block effective intervention. The panics caused a dramatic rise in the amount of currency people wished to hold relative to their bank deposits. This rise in the currency-to-deposit ratio was a key reason why the money supply in the United States declined 31 percent between 1929 and 1933. In addition to allowing the panics to reduce the U.S. money supply, the Federal Reserve also deliberately contracted the money supply and raised interest rates in September 1931, when Britain was forced off the gold standard and investors feared that the United States would devalue as well.”

If Banks were forced to write down their housing assets all at once, most assuredly there would have been liquidity issues. .Assets would have had to have been sold at a steep discount to their already sharply discounted values. This would have been inherently deflationary and contractionary to the money supply. So the FED became a market maker.

Ben Bernanke acknowledged that, as FED chair, he would never allow deflationary expectations to become anchored or contract the money supply, in the face of a financial crisis.

(c.f. Bernanke in 2002 "In a speech on Milton Friedman ninetieth birthday (November 8, 2002), Bernanke said, "Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna [Schwartz, Friedman's coauthor]: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again."

Now, I strongly disagree with the TBTF approach. I think it creates moral hazard and imposes the costs of the clean-up ultimately on the tax payer - not the rich elites who created the problems in the first place. That said, given the policy choice, most of the measures make sense to me. You are trying to grow your bank system back to health. What’s more, these decisions were made in a time of crisis and great uncertainty 4 years ago –so in some sense they are yesterday’s war.

It is the FED (ECB) policy of buying MBS, bank debt and US treasuries, AKA quantitative easing, (QE1 focused on on all three while QE2 was only US treasuries) I take the biggest umbrage. I don’t know whether QE1 was necessary; you are allowing banks to borrow for free and paying interest on reserves - there is no way they won’t make money. But you are ultimately worried about market fears and bank runs, so I suppose I would have been talked into going along with QE1 - given the prevailing pessimism of Feb 2009.

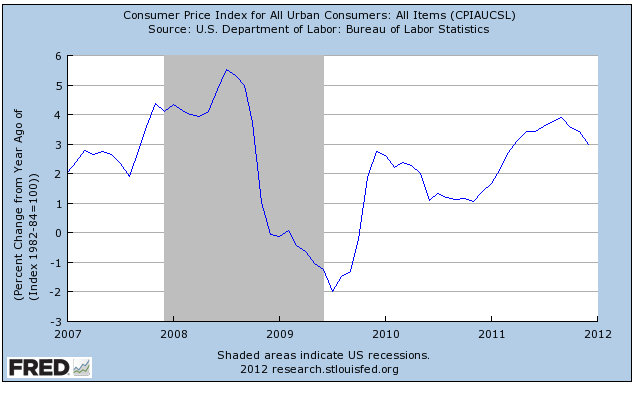

Up to this point, I have agreed or somewhat acquiesced to the FED's policies - so what is my problem? What is the dangerous game the FED is playing? They are trying to see if they can spark moderate inflation in the US economy without causing inflationary expectations to become unanchored. Moderate inflation (3-5%) for five years would restore much of the lost equity in the 1in 4 homes that are substantively underwater, increasing the value of the toxic assets they purchased from the banks at inflated assets prices. The idea is to heal the banks, and homeowner balance sheets, so sometime in the future the Fed can withdraw the stimulus without sparking massive inflation (sell the toxic assets without taking substantive losses).This is an unprecedented level of manipulation of market expectations.

This is Fed speak for what they are doing.

“In setting monetary policy, the Committee seeks to mitigate deviations of inflation from its longer-run goal and deviations of employment from the Committee’s assessments of its maximum level. These objectives are generally complementary. However, under circumstances in which the Committee judges that the objectives are not complementary, it follows a balanced approach in promoting them, taking into account the magnitude of the deviations and the potentially different time horizons over which employment and inflation are projected to return to levels judged consistent with its mandate.”

Ken Rogoff, former head of the IMF, makes the case for this game in the FT.

"If direct approaches to debt reduction are ruled out by political obstacles, there is still the option of trying to achieve some modest deleveraging through moderate inflation of, say, 4 to 6 per cent for several years. Any inflation above 2 per cent may seem anathema to those who still remember the anti-inflation wars of the 1970s and 1980s, but a once-in-75-year crisis calls

for outside-the-box measures. Ideally, both the ECB and the Fed would engage in expansionary policy, as otherwise there could be profound exchange rate c onsequences. Of course, simply trying to stabilise exchange rates without overall monetary expansion – as the G7 seems to have proposed – is far less helpful."

This game is based on managing expectations. It works as long as the market believes the FED is in control. In other words this is life imitating art, this is “Inception”. The FED is telling the market what to believe; planting ideas within ideas.

Can it work? Well so far the US is experiencing moderate inflation as per graph at the bottom of this post. So it is working for the time being.

So QE2, which was unnecessary for deflationary expectations, can be viewed as a tool for generating moderate inflation. This inflation, by the way, as it finds its way to commodities is a chief contributor of revolution in the Middle East.

Will it work? I strongly don’t believe so. I view the policy as unethical , risky, short-sighted and destructive .It does nothing to address the structural unemployment issues that have arisen as a result of trade policies. It imposes the costs of the policies on the poor since they are the ones least able to cope with inflation.

Some market participants are starting to express their doubt and reservations that the Fed can pull this off.

Hussmann recently likened the current situation of the global economy to a Goat Rodeo and expressed similar disappointment in Fed policy.

Excerpts from recent Hussman Letters

"Goat Rodeo - Appalachian slang for a chaotic, high-risk, or unmanageable scenario requiring countless things to go right in order to walk away unharmed.

I could admittedly do better, and would certainly have captured more upside from temporary speculation, had I committed myself to the principle that central banks will act strictly to defend the bondholders of the banks they represent, even if it means trespassing into fiscal policy, subordinating public interest, empowering the worst stewards of capital, violating legal restrictions, and inviting long-term instability. Still, none of those actions improve the long-term outcome for the markets, and more importantly, none have prevented repeated and serious downturns from occurring, despite all the can-kicking.

My impression is that the recent stabilization is owed to a large extent to various central bank actions, primarily by the European Central Bank (ECB), that eased immediate liquidity pressures from the banking system late last year. Though many observers seem to be under the impression that the ECB has not yet "stepped in," this is really only true in the sense that the ECB has

limited its direct purchases of distressed European debt. More broadly, the ECB now has a larger balance sheet - relative to European GDP -than the Federal Reserve has relative to US GDP.

We aren't convinced that the ECB or the Federal Reserve can get themselves back out. It's easy to initiate a "liquidity operation" by creating new reserves and taking securities - be they government bonds or mortgage obligations - as collateral. These actions seem to have no cost or consequence, because people are eager to hold some sort of asset that doesn't default, so

monetary velocity simply falls in exact proportion to the increase in the money supply. And as long as people believe that the central banks can reverse their operations - so that the money being created is not a permanent addition to the money stock - there is no observable impact on inflation.”

Another investment blog expressed a similar view that we will return to stagflation.

“What the foregoing suggests is that, at the moment, we may well be in a period of low inflation, or even deflation, in terms of commercial bank assets. But our unswerving belief is that this cannot last, and indeed it is itself sowing the seeds for QE3. The Fed is obviously very concerned about growth prospects and has now telegraphed this in unusually blunt terms. QE3 is their default weapon of policy and may soon be at hand. The direct monetization of debt even remains a possibility, fueled by Mr. Bernanke’s bet that he can control any untoward effects of the current policy.

We think QE3 will be good for stock prices in the near term, but not much else, and we greatly regret the Fed’s insouciance now

with respect to the dollar’s value. Our best guess now is for a few more years of inflation in the 3-5%, but then an uptick to stagflationary levels. Investors are forewarned.”

I believe in time the behaviour of the Fed will produce a crisis of faith in a sufficient number of market participants that the long run costs or their QE policies will outweigh the short run benefits by a wide margin.

Since the beginning of the crisis in 2008, I have viewed this as the probable consequence e of the FED’s policies. I am currently updating and refining my expectations to where this may be the most benign consequence of the Fed’s policy choices. I am less certain with each passing day that it will be the most likely. .

In a world where the Fed creates a problem by being too accommodative, their response to the problem is being historically accommodative, and the new big ideas (NGDP targeting and QE) are "The FED should be even more accommodative" well this is “Inception”.

Once again I quote, the movie, “With the slightest disturbance, the dream's going to collapse.”

Don’t Stop Believing FED Born Agains --Hold onto that Feeling! We need your blind faith. Wtihout it, the top stops spinning and we all go to hell. Unfortunately, I lost my fatih long ago. -so I can't help.

RSS Feed

RSS Feed