Krugman quotes economist Gabriel Zucman’s (2013) research ‘The Missing Wealth of Nations: Are Europe and the US Net Debtors or Net Creditors?’ attempts to empirically quantify the wealth hidden in tax havens.

Abstract:

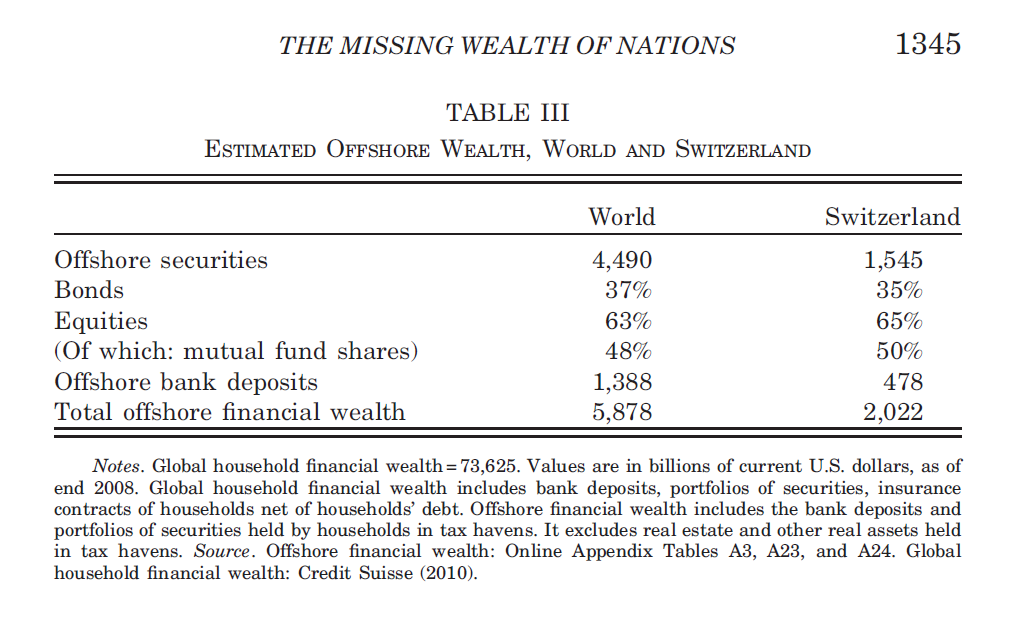

This article shows that official statistics substantially underestimate the net foreign asset positions of rich countries because they fail to capture most of the assets held by households in offshore tax havens. Drawing on a unique Swiss data set and exploiting systematic anomalies in countries’ portfolio investment positions, I find that around 8% of the global financial wealth of households is held in tax havens, three-quarters of which goes unrecorded. On the basis of plausible assumptions, accounting for unrecorded assets turns the eurozone, officially the world’s second largest net debtor, into a net creditor. It also reduces the U.S. net debt significantly. The results shed new light on global imbalances and challenge the widespread view that after a decade of poor-to-rich capital flows, external assets are now in poor countries and debts in rich countries. I provide concrete proposals to improve international statistics.

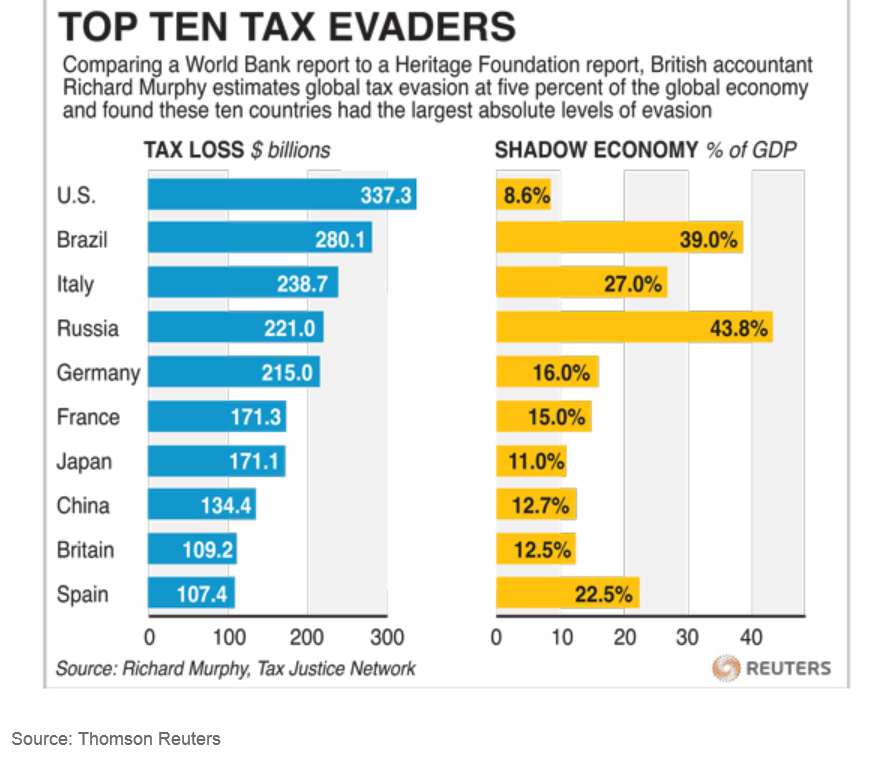

In contrast, in the documentary Tax Free Tour, James S Henry, the former chief economist of the McKinsey & Co estimates that in 2010, 21-32 trillion dollars of the world’s wealth is hidden in offshore tax havens with two thirds of the offshore money coming from the developed world.

But the elites are not content to merely politically engineer historically low tax levels for themselves. Many of them move their wealth into tax havens where they blur the lines between tax avoidance and tax evasion. Banks, eager to serve and retain their elite clients, are enabling and facilitating these corrupt practices.

From Zerohedge:

"Credit Suisse made false claims in US visa applications, conducted business with clients in secret elevators and shredded documents to help more than 22,000 American customers avoid US taxes, according to a scathing report by a US congressional committee.”

RSS Feed

RSS Feed